Chill Time For Agency Mortgage REITs & Fixed-Rate Preferreds

- It's time to chill for a bit. Interest rate volatility increased. Wait for the next round of updates.

- The huge run higher in Treasury yields is making targets a bit dated, even though they are only a few days old.

- I use the rate on a 5-year Treasury and the value of a fixed-rate MBS to get a feel for the swing in book values.

- Since volatility is high and book values are swinging, I suggest waiting for the next updates to targets. I'm going to say it again to make sure it's clear.

- The update for mortgage REIT common shares usually comes out Sunday night or Monday. Just wait on the sector until the update.

When interest rate volatility is high, you may hear me say that I'd rather buy agency mortgage REITs on a Monday or Tuesday.

It's not about the day of the week. It's about placing my trades shortly after getting Scott's updated values. We have updates most weeks, whereas most analysts have 1 or 2 updates per quarter.

When interest rate volatility is high, more frequent updates are an even bigger advantage. Granted, I still prefer to trade when rate volatility is lower or when discounts are at extreme levels. However, more frequent updates allow us to be more accurate about the size of those discounts.

Our estimates and targets are from 10/13/2023. That's last Friday.

It has been a wild 3 days.

Many agency mortgage REITs own lower-coupon MBS because they don't get wrecked with prepayments if rates fall. If you're paying 4.5%, you're not going to refinance because rates fall from 7%+ to 6%. That would be dumb.

Prepayment is assumed to be very low, so the bonds last much longer. The downside of that is that higher rates can still really hammer the values.

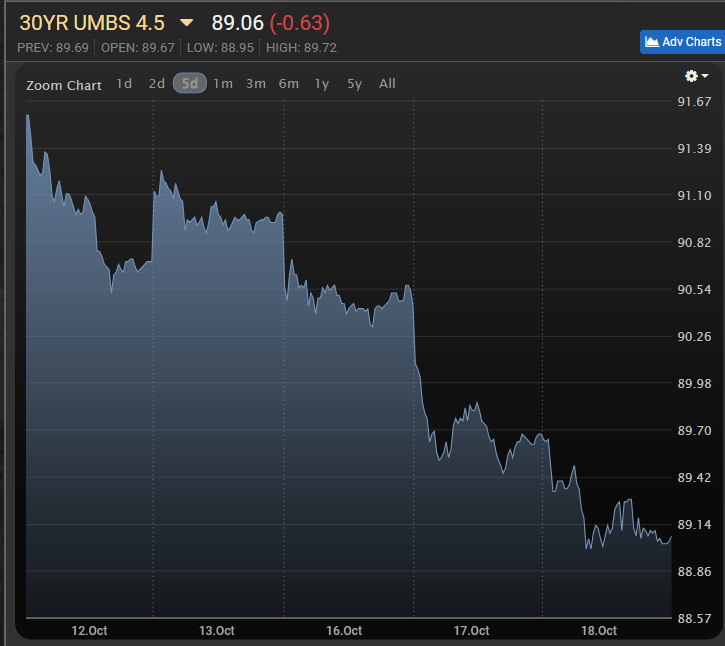

This is what happened to the 30-year fixed-rate agency MBS with a 4.5 coupon rate:

Source: MBSLive

That's just 5 days. Specifically, since Friday evening the MBS fell from $90.98 to $89.06. That's down more than 2%. Remember that the mortgage REITs are using a substantial amount of leverage. Consequently, they would lose 2% several times.

Dirty Math

Alternatively, you could say they were losing $1.92 from the asset value for $100 of face value. Either way is fine. It's the same event.

Mortgage REITs hedge. But if a mortgage REIT was shorting a 5-year Treasury, the gain would only be about $1.44 per $100 of face value.

If you were to lose $1.92 and gain $1.44, you would have a net loss. Doesn't seem like much, but it's much more significant after adjusting for leverage.

Since that MBS was already trading at a big discount to face value ($90.98 is a big discount), it should be carrying quite a bit of duration risk. It really doesn't like higher rates. If I were using an MBS with a higher coupon rate (trading closer to face value), I'd probably use something shorter than a 5-year Treasury.

Clarity

No mortgage REIT just owns the 30-year fixed-rate agency MBS with a 4.5 coupon rate. But several do own a pool of 30-year fixed-rate agency MBS with various coupon rates.

Further, no mortgage REIT hedges exclusively by shorting 5-year Treasuries. But it can be used as a very rough "back of the envelope" calculation. It won't give you the "right" number, but you'll usually be in the ballpark.

This quick math does not replace what Scott Kennedy provides. His estimates are vastly more precise. This is only a way to measure trends.

Normal Use

Usually I use this method after prices drop to verify that BV changes will be fairly minor. If I can confirm that BV changes should be minor, then a big price drop is a big increase in the discount.

This time, it tells me that BV changes may be bigger. Therefore, I will favor waiting for the next weekend so we have another batch of updated figures.

Your Goal Vs. Management's Goal

The investor seeks to maximize the returns on their investment. For the shareholder, that is change in share price + dividends.

Management should seek to maximize total economic return (change in BV plus dividends). If they succeed, the price should eventually reflect it.

Therefore, your goal is generally to find shares at an attractive valuation, and sell at a higher valuation. It's that simple. You get a big discount and sell at a smaller discount.

If management drives strong total economic returns during that period, they are enhancing your returns.

If they lose a bunch of book value, they are damaging your returns.

You can't do much to predict book value in the future (unless the REIT is wasting shareholder's capital, fundamental analysis can uncover that). Instead, we use current estimates for book value and consider which REITs are more likely to do better than others given the environment we see.

This is evident in Scott's picks, which have generally provided far better returns than the mortgage REIT index. We've focused on buying at attractive discounts and they've generally protected their book value much better than other mortgage REITs.

Scott's largest mortgage REIT allocation is Rithm Capital Corp. (RITM) and mine (for common share) is Ready Capital (RC). They've each done vastly better than the sector at protecting book value.

Preferred Shares

I've been emphasizing repeatedly that I would focus on the fixed-to-floating shares with floating dates in the next 18 months or so. That remains true. The latest surge in interest rates will put more pressure on price targets for the fixed-rate preferred shares.

It's not a big factor for the fixed-to-floating shares that float soon. Since the floating rate resets, a higher discount rate is offset by a higher coupon rate soon. There is still some concern about the macro environment and credit spreads, but discount rates won't have a material impact on shares that float soon.

TL;DR

Simple version:

- BV down. Agency agency mREITs whacked.

- Targets are based on Friday's rates. Today's rates are different.

- Scott can absolutely model through this kind of mess, but I wouldn't want to trade before getting the next batch of targets.

- I encourage investors to wait for next week to get Scott's updated targets. Too much volatility right now.

- There will not be new targets for mortgage REIT common shares before the next update.

- Expect negative revisions to fixed-rate preferred share targets. I'm still focused on fixed-to-floating shares that should float within 18 months or so, preferably sooner.

Member discussion