CCI: Q4 2023 Update

Crown Castle (CCI) announced Q4 results.

No major surprises. Only modest ones.

Appreciate the same-day update? Tap that heart icon at the top (or bottom).

My observations as as follows:

Executives

- The old CEO (Jay Brown) was already out.

- The new interim CEO (Tony Melone) was already in.

- The CFO ( Dan Schlanger ) had planned to leave before the pressure from Elliott Management.

- A new deal was reached to keep the CFO.

Guidance

- All guidance metrics were maintained. Seriously, all of them.

- I follow “trust but verify”. They said it was maintained, but I dug through the values anyway.

- Maintaining guidance is usually neutral.

Fiber

- Intermin CEO reiterates ongoing strategic review of fiber business.

- Analysts may question the decision to maintain guidance on discretionary capital expenditures.

- Guidance of $1.53 to $1.63 billion in discretionary capital expenditures ($180 million from towers).

- Fiber capital expenditure guidance was maintained at $1.35 to $1.45 billion. This is too high.

- If the guidance for discretionary capital expenditures is not reduced in the Q1 2024 release, analysts may become pretty annoyed.

It’s just way too much fiber.

Reading Between The Lines

The old CEO abruptly departed under intense pressure from the activist. That departure was in December.

The board didn’t have much time to appoint an interim CEO and he hasn’t had much time to get up to speed.

It appears evident that CCI wasn’t ready for the press release. Therefore, I think the decision to maintain all guidance figures was based on simplicity.

Signs of a Rushed Release

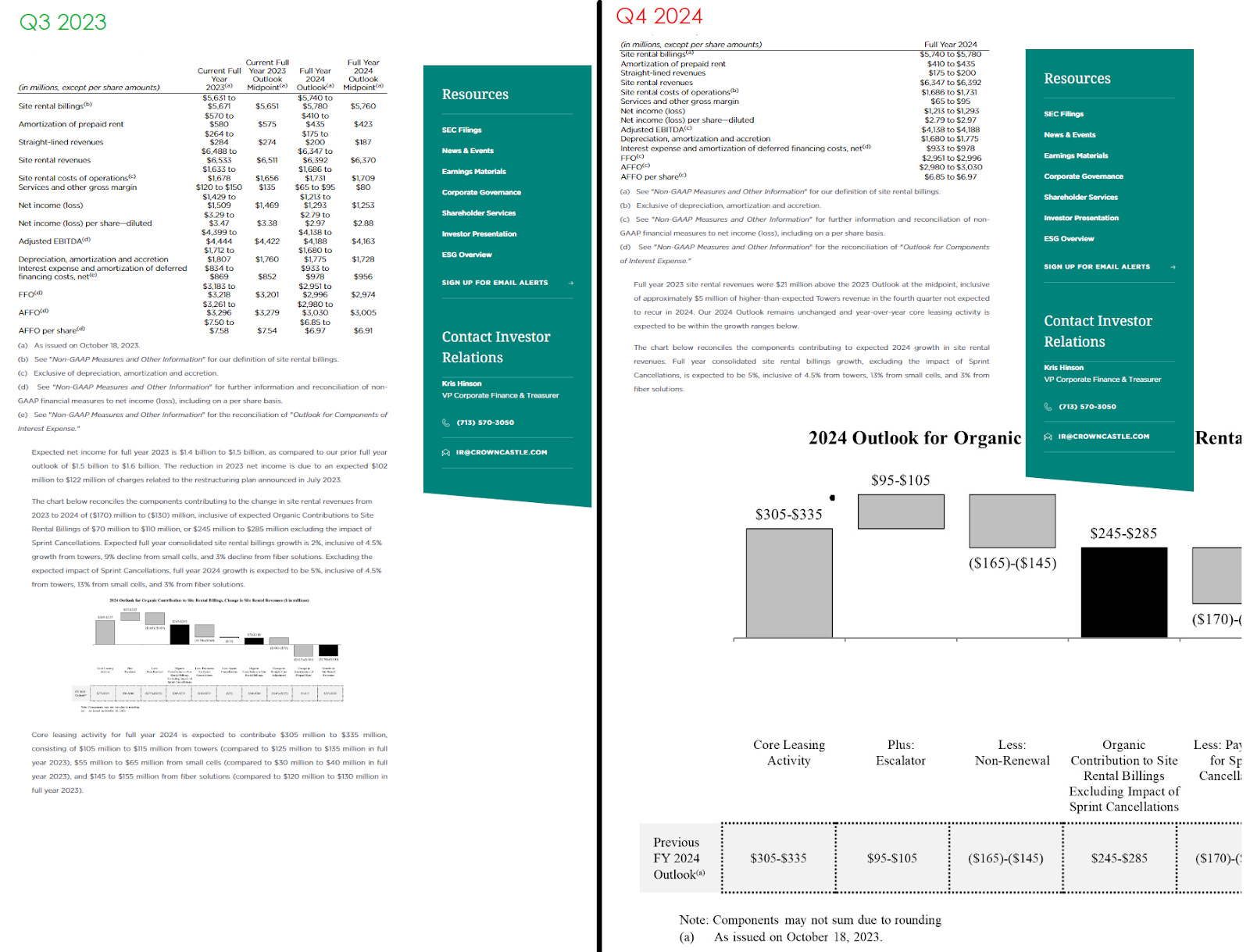

It’s subtle, but see if you can spot the difference in the layout for the Q4 2023 release and the Q3 2023 release:

If you noticed that the charts were not sized to correctly match the release, you have eyeballs.

I verified it wasn’t a local issue.

I’m not reading that deep just on the charts though. Mistakes like that can happen. They’ve happened to me.

Instead, I’m looking at the quarter-over-quarter change in commentary and the numbers that should’ve changed.

Here are the key facts:

- CCI held guidance steady on interest expense. That doesn’t follow standard practice.

- We would normally expect executives of any large REIT with any adjustable rate debt (about 10% of CCI’s total debt) to swing interest expense guidance based on changes in the forward curve.

- When CCI presented Q3 2023 results, the 2-year Treasury was at it’s peak of 5.225%. Today, it is 4.384%. Further, credit spreads shrank significantly. That means corporate debt yields are quite a bit lower.

- Today, CCI could issue short-term, medium-term, or long-term debt at lower rates than they could have achieved in October 2023.

- Therefore, keeping guidance for “interest expense on debt obligations” stead at $922 to $962 million means they didn’t update for the yield curve.

Why do we care so much about updating for the yield curve?

Because we can’t prove that guidance should’ve been updated elsewhere.

However, we can read the yield curve and tell that forward projected interest expense would definitely be lower today than it was in the middle of October.

What I See

I think management didn’t want to commit to any changes until they had more time to review.

Quite frankly, this earnings release should not be the top priority for management. The quality of guidance should not be the top priority.

Any significant changes to the fiber portfolio (such as selling it or dramatically reducing capital expenditures) could significantly alter guidance.

As I mentioned in our Q3 2023 update, the year-over-year growth figures are misleading anyway. They include metrics we want to remove with adjustments anyway.

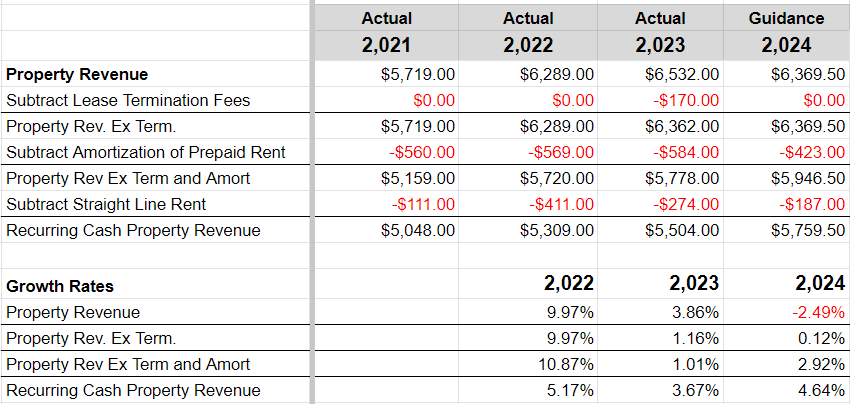

Note: In the tables below, I use total values for the company. Normally, I would insist on per-share values. However, there has been no material change to shares outstanding in the last few years. Therefore, using total values is fine.

The first table evaluates revenue and growth. I’ve adjusted it to include the full-year 2023 results. Since the guidance was unchanged, that part was easy:

The thing you should recognize here is that officially “revenue is falling”. However, that isn’t the case. If CCI sells a bunch of assets, that would bring revenue lower. However, cash revenue from the portfolio (the real estate) is still growing.

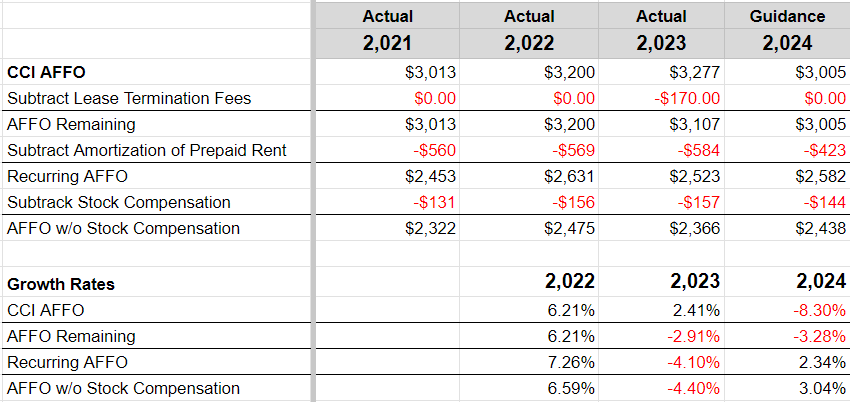

Next, we want to adjust the AFFO values:

In 2023, CCI reported “growth” because of crappy non-cash and non-recurring items. I predicted this in advance, so it’s no surprise.

Sorry, lease termination fees are not a reliable source of income.

That lease termination fee income was offsetting surging interest expense.

In 2024, growth in interest expense should be smaller because we already experienced the surge in interest on variable rate debts.

That makes it easier to grow AFFO per share.

However, it would be wise for management to slash discretionary capital expenditures.

By slashing capital expenditures, they could reduce the growth rate in debt. That’s a great way to reduce the impact of higher interest rates.

Conclusion

There isn’t much to rate in this quarterly update.

The biggest factor should be a change in guidance, but guidance was precisely maintained.

Normally we could evaluate that, but in this case, we’ve determined that guidance was maintained for simplicity.

For our purposes, that’s the same as just not updating guidance.

However, I’ll focus on two things:

- Commentary about continuing the strategic review is good.

- Leaving guidance for capital expenditures is bad.

I would’ve preferred a “range widening” for capital expenditures.

Instead of leaving capital expenditures for fiber at $1.35 to $1.45 billion, they should’ve dropped the bottom end significantly.

I’m going to initially rate the quarter as “N/A” out of 10.

It’s not a number. It’s not particularly good or bad. We just don’t have enough new information yet to assign a rating.

The earnings call might change that, or it might not.

Please feel free to share this article. It helps our website presence grow!

I’ve set this article to be entirely free, so you can share it with anyone.

Disclosure: Long CCI, SBAC, AMT

Member discussion