Buying Another Preferred Share at Bargain Pricing

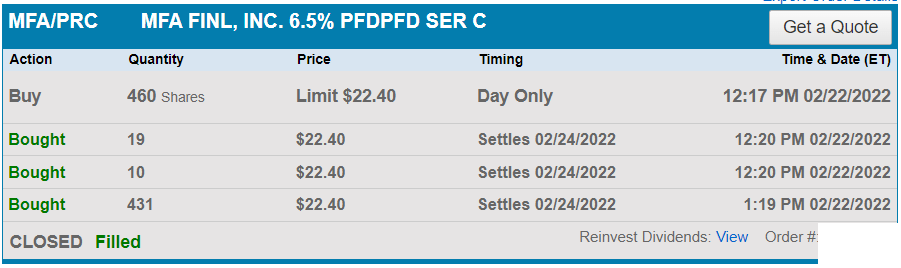

Trades Placed

- Purchased 460 shares of MFA-C (MFA.PC) at $22.40.

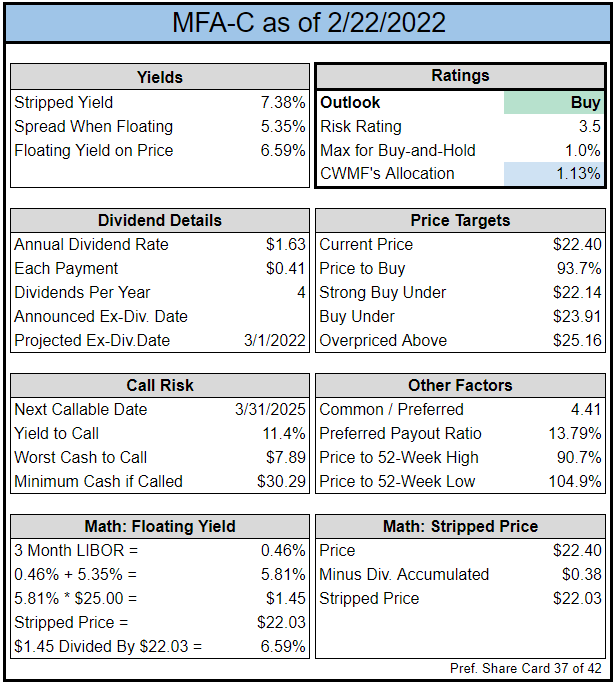

Index Cards

Source: The REIT Forum

Brief Commentary on MFA-C

We telegraphed this trade a week earlier in the paid version of “Preferred Shares: What to Buy and Sell Amid the Market Disruption” (subscriber article through The REIT Forum on Seeking Alpha)

We wrote:

MFA-C (MFA.PC) is the fixed-to-floating share. The spread on MFA-C is neither great nor poor. At 5.345%, it’s about right for the risk rating. However, shares are trading at only $22.23. That’s a huge discount to call value and it pushes the yield materially higher. If short-term were to run around 1.7% (an example based on the yield curve), then the floating rate would result in a moderate dividend increase which would boost the stripped yield from 7.42% today up to 8.05%. We should note that if short-term rates do not increase, the yield would dip instead. However, the discount to call value is large enough that the risk/reward on MFA-C is becoming quite favorable. If these shares remain low compared to the rest of the sector, we may pick up shares of MFA-C. The increased targets, explicit call out, and poor liquidity might combine to prevent that from happening. But if the rest of the sector remains roughly flat and we can pick these up for $22.23, that would be attractive.

In the conclusion we added:

MFA-C got the largest increase in targets at $.50 along with a reduced risk rating. If shares remain this cheap relative to the sector, we may open a position. We would use a tax-advantaged account as the potential for a capital gain plays into our decision.

We also ended the article with the additional disclosure:

If MFA-C remains cheap, we may open a position in shares. If it promptly outperforms the sector by any material amount, we may simply sit on the sidelines.

Due to poor liquidity and our adjustment to the price target, we felt it was important to delay our trade to ensure any subscribers who wanted to enter the position had the opportunity to do so. Shares of MFA-C rallied a bit last week but came out a bit weaker today.

We're comfortable sitting on these shares for a while and collecting the income, but we're also willing to close out the position if the market offers us a significant capital gain. The shares offer a respectable yield today and the floating rate won't start until 3/31/2025. That is plenty of time for the short-term rates to increase. If we ended up holding shares through that date and the shares were called, the capital gain would be a great source of comfort.

We think it is probable that these shares recover to trade above $24.00 and perhaps even closer to $25.00 well before 3/31/2025. That allows us to be flexible in our approach. If shares remain near the current price, that would be great as well since it would be a solid source of income and we always want more positions worthy of recommending.

Account

These trades were placed in our tax-advantaged account.

Execution

Source: Schwab

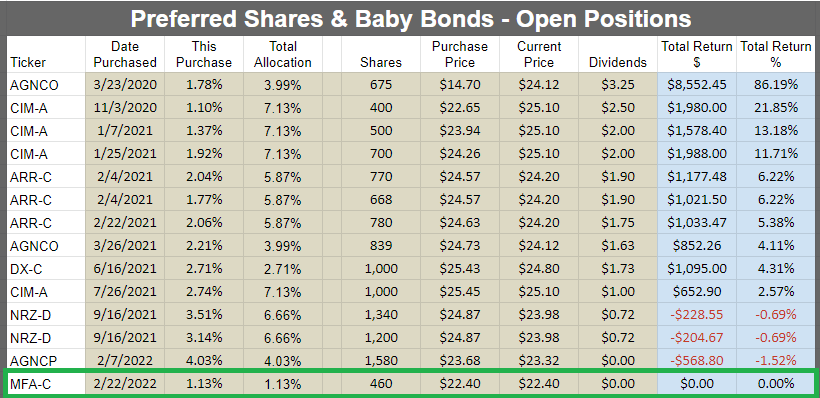

Returns for Open Positions

Source: The REIT Forum

Most of our preferred share positions are still holding up decently. They've dipped, make no mistake. They trade at attractive entry prices now. However, the dividends we've collected so far have the total returns positive on most positions.

Conclusion

MFA-C is offering investors an attractive combination. Shares carry a fixed-rate today, but switch over to a floating rate in a few years. The spread is high enough that if short-term rates increase, the dividend rate might be higher after the floating rate kicks in. Shares can't be called for the next three years. If they were called afterwards, investors would be comforted by the significant capital gain required on any call.

We're comfortable using the shares as a source of income for the portfolio. However, we expect a recovery in the price well before 3/31/2025 and would be comfortable reallocating at the right price.

If you’re seeing this article through our webpage and would like to receive e-mails with the entire article when we publish, you can sign up below:

Member discussion