Bullish on NRZ-D

Summary

- Our initial target buy-under price is $25.22. Shares are currently trading at $24.74, so we like the price.

- Shares currently are trading under a temporary ticker of NRZDP.

- The shares can be valued based on comparison to other preferred shares from NRZ. The comparison reinforces our belief that NRZ-D is attractive.

- We expect to open a position tomorrow so long as the price remains similar and there are no major developments.

This is an article prepared for subscribers of our paid service earlier today.

To thank our followers who decided to get e-mail alerts for our Substack page, we’re providing the subscriber exclusive article here. From time to time, this service will have articles that simply never go out on the public side of Seeking Alpha.

New Residential (NRZ) issued a new preferred share. That preferred share will eventually be called NRZ-D (NRZ.PD). Before it transitions to its permanent symbol, it is trading under a temporary symbol. That temporary symbol is NRZDP. Subscribers have reported success placing trades for it on Schwab, Vanguard, and Fidelity. After shares transition to their permanent ticker, Fidelity may restrict buying as it will most likely be considered a “Fixed-to-Floating” security. Technically, NRZ is referring to this as “Fixed-Rate Reset” security. Since the rate resets, we’re grouping it in as a fixed-to-floating security.

The terms on NRZ-D look a little better (for the preferred shareholder) than I would've expected.

Target

Our initial target buy-under price is $25.22. This price includes all adjustments (such as dividend accrual). That’s convenient for investors because it means they don’t need to make any adjustments. Currently, shares are trading around $24.74. It is common for a preferred share to start trading under call value as the underwriters look to sell millions of shares in a few days.

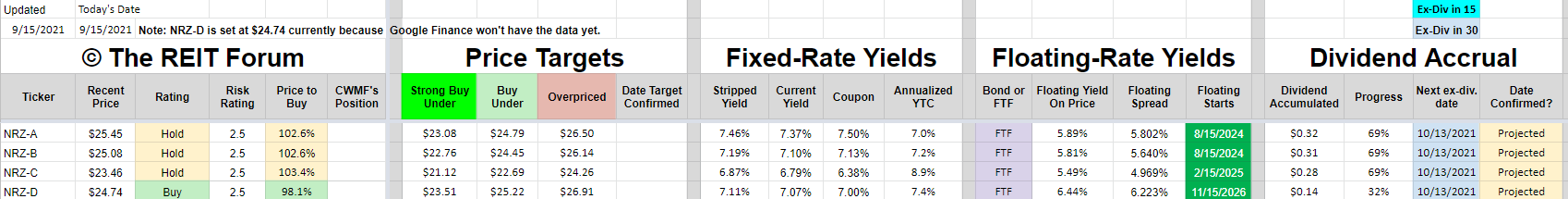

To evaluate NRZ-D, we want to compare it to some similar shares in the form of NRZ-A (NRZ.PA) and NRZ-B (NRZ.PB).

Comparison

Call protection lasts until the coupon rate resets on November 15th 2026. For comparison, NRZ-A and NRZ-B begin floating on 8/15/2024. That’s an extra 27 months of call protection.

NRZ-D’s 7.00% coupon rate is lower than the 7.5% on NRZ-A or the 7.125% on NRZ-B. However, with about 3 years left before NRZ-A begins floating, the difference is about $.375 per share in fixed-rate dividends. NRZ-A is trading at $25.50.

If the preferred shares are not called, NRZ-A would get a 5.802% floating spread (plus the short-term rates). That’s the highest among the first 3 NRZ preferred shares.

NRZ-D would get 6.223% plus the 5-year Treasury rate. We find that spread more attractive (6.223% is bigger than 5.802% and we like the 5-year Treasury as a base), therefore we think NRZ-D would be more attractive than NRZ-A after both shares begin floating/resetting rates.

Tiny Upwards Adjustments

We expect to boost preferred share targets slightly with the other NRZ preferred shares increasing by about 1% on average. However, the other shares wouldn't top NRZ-D.

Following the rally of the other picks we recently highlighted, PMT-C (PMT.PC) and NYMTL (NYMTL), NRZ-D is the only preferred share currently sitting in our target range. Consequently, it should be no surprise that we are interested in picking up shares.

Other Commentary

Since we are just opening coverage on NRZ-D (as it is just being issued), we wanted to get this report out to subscribers before placing any trades. Given the volume of shares underwriters will need to unload, we expect to find similar prices tomorrow and would look to open a position so long as we don’t have either a significant increase in the price or major developments negatively impacting NRZ or the broader market. We don’t anticipate either of those things happening, so we will most likely be adding shares tomorrow.

We have completed the updates to the preferred share spreadsheet. The price is temporarily fixed in the spreadsheet at $24.74 since we don’t expect reliable pricing data to import until the shares are on a permanent ticker. A quick comparison of the NRZ preferred shares is shown below:

Note: You can zoom in on the images in substack articles by clicking them. They may open on a separate tab. This should even work if you’re reading the article in your e-mail.

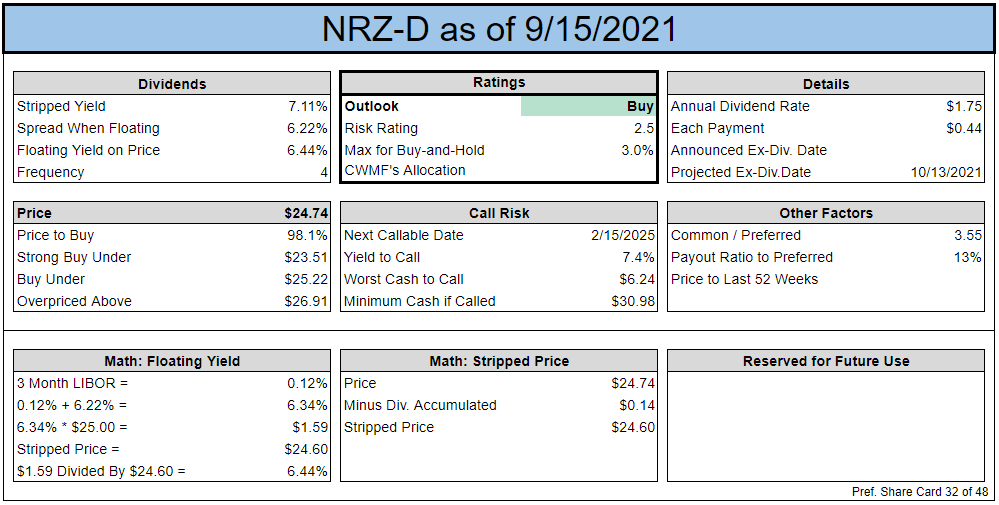

Due to the timing of issuance, NRZ-D won’t reach 100% progress on the dividend before shares go ex-dividend. Instead, the first dividend will be for a shorter period and thus in a smaller amount. Shares begin with $.14 in accrual because shares go ex-dividend about a month before the actual payment date and starting with $.14 will allow the shares to accumulate the right amount of dividend accrual (give or take $.01) by the ex-dividend date.

The latest index card is below:

Disclosures: We are long NRZ and expect to purchase shares of NRZ-D.

If you enjoyed this article, please feel free to forward it to your friends.

Member discussion