Breaking: CCI's CEO Announces Abrupt Retirement! (Free)

Big news out of Crown Castle (CCI).

Jay Brown will retire, effective January 16, from his roles as:

- President

- CEO

- A director of the company

He notified the company of his decision on December 6th, 2023.

I view this as great news for shareholders, even if it isn’t great news for the CEO.

When’s the last time you saw the abrupt departure of a CEO trigger an immediate after-hours rally?

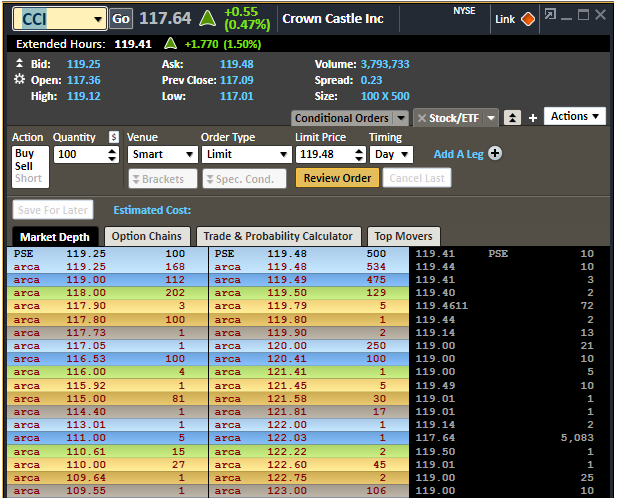

Source: Street Smart Edge

Feel free to answer that. I’m sure there are probably some interesting examples.

I need to remind investors that we downgraded CCI’s price targets significantly following an evaluation of their ineffective capital expenditures program.

We reduced our position in CCI, but didn’t close it. The proceeds from sales were used to purchase more shares of SBA Communications (SBAC). Even after the reduction, CCI is still a pretty big position.

Performance

Thus far, CCI underperformed expectations. There were a few factors:

- Capital expenditures in fiber provided weaker-than-expected returns.

- Adjustments to expectations as management continued investing in fiber despite higher interest rates.

- The random factor implicit in any investment. Prices are never perfectly efficient.

- The impact of higher interest rates. This last one was the biggest factor by a large margin.

The part I missed in my initial assessment of Crown Castle was number 1. It was pretty easy to miss that one since it is common to take management’s word about the yield on new investments. Eventually, I became really curious about the multi-year revenue growth and started modeling out their capital expenditures for years. I reached out to Crown Castle seeking an explanation, but they didn’t reply.

Then, the Elliott report came through and validated my calculations.

Prior Price Target Adjustment

Based on the difficulty of ousting management and overhauling plans to spend literally billions of dollars of capital expenditures, I decided it was time to downgrade CCI’s price targets. I wanted to adjust for the fact that they would probably “invest” a bunch more into fiber.

Elliott Winning

Elliott already achieved two big wins.

- The departure of the CEO.

- The appointment of an interim CEO.

Elliott campaigned for CCI to have leadership with more expertise in this kind of technology. Leadership that would be positioned to better evaluate the fiber business.

The interim CEO appears to fit the bill:

Mr. Melone has over three decades of experience in the telecommunications industry, including having served as Executive Vice President and Chief Technology Officer (“CTO”) for Verizon Communications from December 2010 to April 2015. In addition, Mr. Melone served in a variety of positions with Verizon Wireless from 2000 to December 2010, including as Senior Vice President and CTO from 2007 to December 2010.

CCI couldn’t lease enough small cells per mile of fiber to get the economies of scale they needed. Expertise as the CTO for Verizon (VZ) should give him some insight. Hopefully, his tenure with them ended better than Jay Brown’s tenure with CCI.

Dividends?

New management has no history referencing the dividend. The short-term dividend risk is ramped up because the dividend rate is still a decision by the board.

On the other hand, Elliott has been in favor of having a high dividend rate. They wouldn’t push for a dividend cut that would damage the value of their holding.

If Elliott is successful in convincing the board to slash capital expenditures, it leads to better dividend coverage. From a fundamental level, this is clearly positive. However, assurances from management would still be positive.

Considering More Adjustments

I’m considering an upgrade to CCI’s targets. This is a material positive development and it warrants an improved valuation. I don’t want to make a knee-jerk adjustments, so I’ll take a bit to think about it. There are positive and negative factors in play.

Positives:

- Elliott is winning. This change in leadership makes the company more valuable.

- Getting the CEO ousted so quickly bodes well for other changes. It implies Elliott has some leverage.

- New leadership means a strong probability that we see changes to the capital expenditures profile.

- Any announcements that CCI is going to focus on Elliott’s plan could trigger further upside.

Negatives:

- CEO and CFO both leave the company rapidly. That usually foreshadows something negative. This is an opportunity to include negative announcements while attributing it to the last guy. That could send shares lower.

- We don’t know how much of the capital expenditures are already under contract. There may be some costs to escaping any bad deals. On the other hand, carriers were not particularly excited about the product anyway (based on leasing data).

- I doubt the board reached a deal for the CEO to forfeit compensation. It seems more likely that he was leaving to take a severance package. That would usually presented as a non-recurring item, but analysts may adjust for it in different ways.

Overall

I’m definitely viewing this as a net positive. The biggest concern at the moment is simply deciding how to interpret Elliott winning so quickly. This is a great area for discussion, as there could be several points of view. When evaluating this kind of unique situation, it’s best to view it from several angles.

CCI is still well below our price target, even after those targets were reduced a few days ago. If CCI can sell off the fiber business at a reasonable valuation, the cell tower business could be attractive. It actually generates the kind of growth we want to see while requiring only minimal capital expenditures.

Member discussion