Blue Orca Fumbles Incompetent Attack on Sun Communities

Blue Orca Capital released a short attack on Sun Communities (SUI).

Spoiler: Blue Orca doesn’t specialize in REITs and that’s painfully obvious by the end.

I’ll be reviewing and evaluating the claims.

A strong rebuttal generally requires organizing the claims so they can be evaluated individually. Blue Orca Capital assisted somewhat in that regard by numbering some of their claims, but they also included claims outside the numbered system.

The most notable of those claims is: “SUI is already heavily levered and has little room to maneuver at 6.0x Net Debt / Recurring EBITDA.”

That claim has 3 parts:

- SUI is heavily levered. This is false.

- SUI has little room to maneuver. This is false.

- SUI has about 6.0x Net Debt to Recurring EBITDA. This is true.

6.0x Net Debt to Recurring EBITDA is not heavily levered for a REIT that invests in strong properties trading at low cap rates. Since SUI invests in those high-quality properties, that’s a very reasonable amount of leverage.

It isn’t “low”, but it absolutely is not “heavily levered”. SUI has a BBB credit rating from S&P. That’s a good credit rating. Consequently, this claim hurts Blue Orca’s credibility. They had one true fact, but they created two subjective claims that could easily be interpreted by readers as facts. If we evaluate them as facts, they are simply false.

The Numbered Claims

There are 5 numbered claims.

- An undisclosed personal loan. Bad optics, but I don’t see a big concern here. It would be reasonable for that member of the board to resign for their role in creating bad optics for the company. However, I will regularly suggest that board members should resign because I believe board members should be held to vastly higher standards. Simply put, this is pretty mild as far as “problems” go.

- The CEO was accused of fraud around a life insurance policy that was completely unrelated to the company. He was not convicted. He was never even charged with wrongdoing. Throw this allegation in the garbage. Supposedly there was some “subsequent litigation” brought against the CEO by “friends and family of the indicted parties”. By my understanding (not a lawyer), that means there were other people who were charged with crimes. The “friends and family” of the people who were facing charges decided to pursue a civil case against the CEO. This doesn’t belong in stock analysis. I want to express the stupidity of this point. Blue Orca says that the defendant’s (or convict’s) lawyer says that a Department of Homeland Security says that the CEO “should be in prison”. Hearsay much? This is on page 2. If you have a good argument against a company, don’t waste your first bullet points and pages on hearsay.

- Blue Orca claims that Sun Communities underreports recurring capital expenditures which would lead to inflating AFFO. Based on the idea that AFFO is inflated, they argue that the price is inflated. We will investigate.

- Blue Orca claims that organic growth is manipulated by including converted and expanded properties within same-store NOI (Net Operating Income). I disagree with the use of the word “manipulated” here. Yes, SUI appears to include converted and expanded properties within same-property NOI. I came to that conclusion years ago. I don’t like this method of reporting, but SUI is not unique in this regard. In my opinion, this is pretty standard and there isn’t a great solution to it.

- Blue Orca claims that some old accounting issues from a case that was dismissed casts a “shadow over current financials”. The case was dismissed, so I’m not impressed. The argument goes on to highlight some goodwill impairments. It also mentions some financial statements that were restated because of the timing of goodwill impairments. We already knew about that and determined it was a non-issue. Impairments are a non-cash issue and I’m not particularly concerned with the timing of impairments for an equity REIT. They bought some real estate. Interest rates ripped higher. Cap rates increased. The value of the real estate fell because of higher cap rates. I’m not concerned about this.

After a brief review of those points, I’m tossing points 1, 2, and 5 in the garbage as items that don’t matter.

Since this report was 42 pages and I can eliminate those points from the start, I’ll be skimming the related slides.

Just as a brief note here, you should start strong, end strong, or both. Why are the only points worth looking into the points in the middle?

Brief Notes on Skimmed Slides

Looking at the character assassination attempts, we have statements that were made “under oath by a doctor who admits he took money to falsify medical records”.

Zero credibility.

Perhaps next we can have a small child who swears the CEO transformed into a killer robot?

We’re on page 19 before we get back to fundamentals.

Wasted Time

One of the hardest parts of doing a solid rebuttal is the importance of being right on every point.

In my rough draft, I was operating under the assumption that Blue Orca made a certain mistake with regard to capital expenditures.

However, they actually made a different mistake. Unfortunately, that meant rebuilding a large chunk of the article. I wouldn’t want to just thrash a strawman argument. Since I intend to demonstrate the flaw in the calculations, I aim to demonstrate both the correct and incorrect calculations.

As with many “short reports”, the article appears to be designed to create fear. Laying out the exact fundamentals, or providing proper context, would undercut the thesis rather than promoting fear. To disprove the allegations (which were never proven), we have a more difficult challenge. We must be organized in presenting the facts, so readers have a deeper understanding. Therefore, I have to lay more of a framework than I would otherwise.

SUI Buys Real Estate Then Improves It

SUI acquires a high volume of real estate. They’ve done that for a long time. Many of the acquisitions have worked out well for shareholders. There were a few bumps recently related to a bad loan, exchange rates, the UK economy, and interest rates. Those factors weighed on SUI’s results for the last few years.

When SUI acquires real estate, they often make material improvements to the real estate. In theory, as the buyer, they could delay the purchase and pay a higher price in exchange for the seller making those adjustments. That would be slow and inefficient. Instead, SUI buys the property knowing it needs improvements. Over the next couple of years, they make those significant improvements. When the landlord improves the real estate, rather than just maintaining it, it doesn’t fall under recurring capital expenditures.

New properties will regularly require much higher levels of capital improvements to reach SUI’s standards.

Defining Capital Expenditures

Typically, capital expenditures would include acquisitions. That’s a form of non-recurring capital expenditures. However, in this article, we will be excluding the purchase price of new properties. Why? Because we need to utilize the same language as Blue Orca while disproving their argument.

Blue Orca Overreaches

Blue Orca had one nice point regarding capital expenditures.

They take aim at Sun Communities for attributing all of the capital expenditures at newly acquired properties to capital improvements.

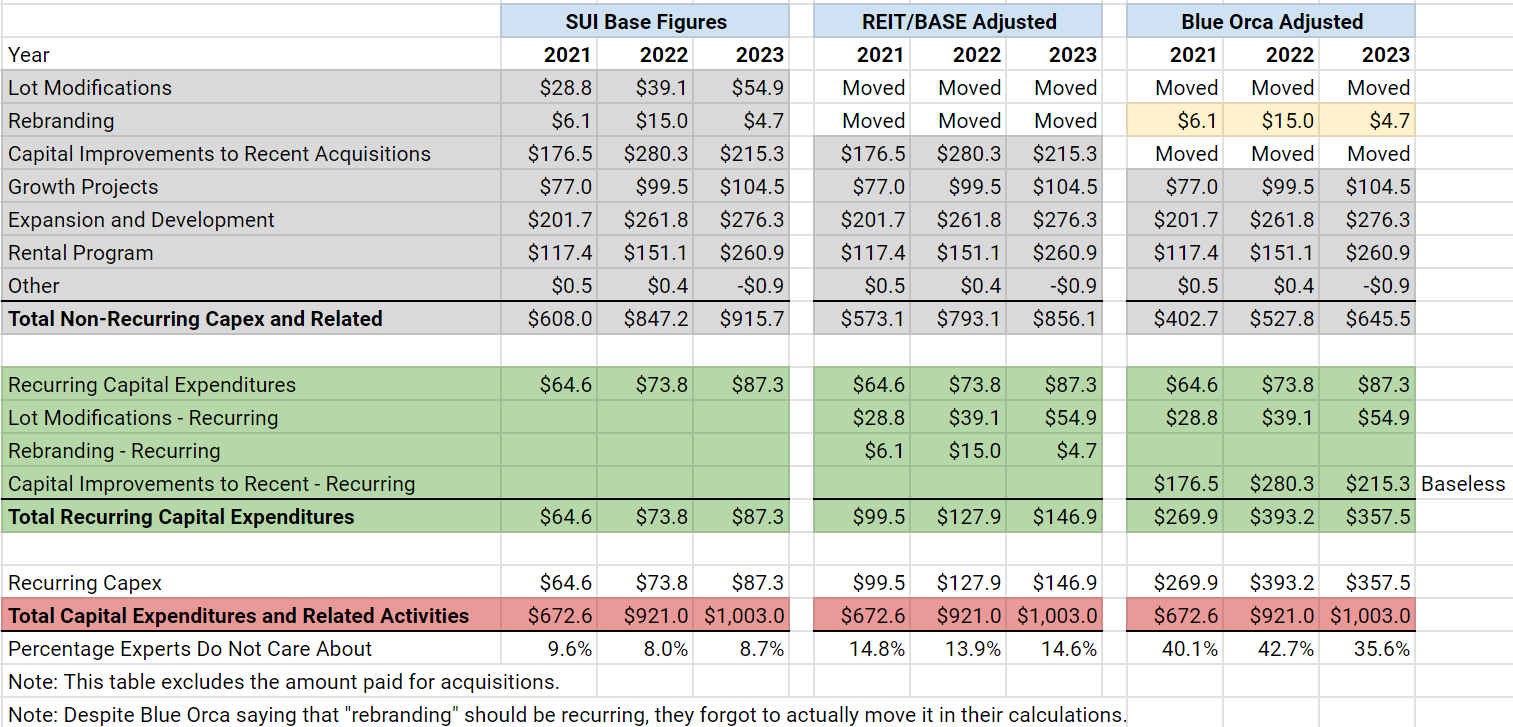

Here’s the math in that regard:

In theory, we could assume the new properties have similar levels of maintenance capital expenditures as existing sites. If we did that, we would have a pretty quick calculation (seen above) to estimate maintenance capital expenditures for those sites. It wouldn’t be perfectly accurate, but it would probably be pretty close.

It would come out to about $24 million for 2023, which would be $.19 per share. That’s roughly around 3% (rounded) of AFFO. Far from earth-shattering and certainly not enough to get investors worked up into a panic. Rather than taking the point, Blue Orca makes the ridiculous and baseless assertion that 100% of capital expenditures at new sites should fall under recurring capital expenditures. Does that sound absurd? It is.

Rather than scoring the point on $23.9 million, they are arguing for $215.3 million (the entire amount of capital expenditures on new acquisitions).

Why would they do something so utterly absurd?

I can’t assign motives, but I can recognize them. Blue Orca had a narrative to support.

Blue Orca built their attack on recurring capital expenditures on the (incorrect) idea that various REITs should typically have a similar ratio of recurring capital expenditures to total capital expenditures. There is no evidence that this should happen. Further, there was ample evidence, even within their report, that it often does not happen. That evidence that it often does not happen should have given the analyst pause.

Recurring Capital Expenditures

Here is the claim:

“Peers report 4-8x higher levels of recurring capex as a percentage of total capex, making SUI an inexplicable outlier (even compared to its closest manufactured home comp).”

Finding:

“An absurd and shameful misrepresentation of reality.”

First, allow me to emphasize that “recurring capex as a percentage of total capex” is a junk metric. In my career, I can’t recall ever seeing any REIT analyst use that as a metric. As REIT analysts, we don’t calculate that because it isn’t useful. Blue Orca’s comparison of peers could have excluded SUI and it still would’ve been obvious that the peer group reports substantially different ratios.

Regardless, I’m going to demonstrate the calculations today, so investors have a better understanding of the math Blue Orca attempted to use. However, I want to start by referencing how much these figures were spread out:

- Page 19 contains the claim.

- Page 20 had two charts for comparisons to peers, but didn’t demonstrate the math.

- Page 26 contains a reference to adjustments Blue Orca wants to make, but it doesn’t demonstrate the underlying math either.

- Page 39, in the appendix, demonstrates the value they were using for “total capital expenditures”. This is a value SUI labeled as “Total Capital Expenditure and Related Activities”.

- Combining some references from page 26 with page 39 allowed me to determine how Blue Orca was probably running their calculations. If this isn’t the equation they used, it would be a remarkable coincidence.

Note: Recurring capex and total capex are both useful metrics on their own. The ratio between them adds nothing.

Four Times As Much

The report suggests that “SUI never explains why its closest peer reports 4x times as much recurring capex as a percentage of total capex”.

Note: Yes, it says “4x times”.

SUI probably doesn’t explain it because it would be an objectively stupid thing for them to need to address. The report suggests that analysts couldn’t explain this issue either. Well, I’m going to take that as a request for an analyst to explain it. Just keep in mind that it’s still not a useful value.

An Alternative Source

In this article, I’m going to reference REIT/BASE. It is a data tool for REIT analysts and investors. The numbers presented in there are designed to normalize the presentation of metrics between REITs. This is something most equity REIT analysts should know about. We’ve utilized these adjustments for many years.

Calculations To Reach an Irrelevant Percentage

We’re finally at that point where we get to include a big chart.

You’ll find that there are 3 rows in question.

Those 3 rows are listed in both the non-recurring (grey) section and the recurring (green) section.

However, the number will only be assigned to one category each time.

Determining which errors another author made can be challenging when they only show part of their work.

I do need to give them credit for showing part of the work though. Analysts who are terrified of being called out may hide all of their calculations to make it more difficult for them to be proven wrong.

In the text, Blue Orca argued that rebranding should be considered a form of recurring capital expenditures. REIT/BASE treated it that way for a long time. It appears Blue Orca forgot to make that adjustment.

The AFFO Adjustments

Blue Orca claims AFFO is dramatically overstated because of understating recurring capital expenditures. However, that assertion was built on the absurd premise of moving all of the capital improvements to recent acquisitions ($215.3 million) over to the “recurring” bucket. It was not based on using the $23.9 million figure they could have supported.

The other adjustment was regarding “Lot Modifications”. As Blue Orca highlighted, many analysts already know about this category and considered it a form of recurring capital expenditures. Even though many analysts already adjusted for it, Blue Orca pretended that it was inflating the share price. You can’t have it both ways. It isn’t a new shocking revelation and something most analysts have known for years.

The Right Comparison for Maintenance Capital Expenditures

If you want to compare maintenance capital expenditures, you should normalize for the size of the company. The right way to do that is by comparing recurring capital expenditures to rental revenue or net operating income. Rental revenue is much faster and works about as well. It’s also quicker for readers to verify if they so desire.

Since many REITs like SUI don’t actually report AFFO with adjustments for maintenance capital expenditures, I like to use the values from REIT/BASE. I believe the adjustments in the data by REIT/BASE result in numbers that are more meaningful.

You’ll notice that there are three lines for SUI at the bottom so investors can decide which numbers make the most sense:

As evidenced by ELS, the MH park REITs generally have a slightly lower level of maintenance capital expenditures relative to revenue. However, the metric created using Blue Orca’s wild fantasy for recurring capital expenditures is clearly way outside the bell curve. That should be a huge red flag.

Same Property NOI

There are a few arguments around SUI’s use of same-property NOI.

There is a small part that I agree with.

SUI provides same-property NOI and it includes “expansions” and “conversions”.

Expansions:

Because there is a material amount of capital that goes into “expansions”, I can see a reasonable case for SUI providing two same-property NOI figures where one is excluding the benefits of expansions. Those are new lots for rent. They are part of an existing park, but it’s kind of like if an apartment REIT was able to add another floor to an existing building. It would be reasonable to view the numbers with and without the impact.

I wouldn’t just remove “expansions”, but I think providing both sets of numbers would be good for shareholders.

Conversions:

SUI has a bunch of RV sites. They have been working to convert “transient” sites to “annual” sites. That’s great for the shareholders.

It’s the same site. They are using it much more efficiently, so it generates more revenue.

Blue Orca suggests that since they are using it much more efficiently, they should remove it from same-store results.

No. That’s dumb.

When an apartment REIT invests a couple thousand bucks during the turnover to install some better kitchen appliances, do you think they remove that location from same-store results? No. They include it and they recognize the “revenue enhancing capital expenditures”. That is normal. That is expected. That makes sense. Likewise, if SUI converts a site from transient to annual, it is still the same site.

The author writes:

“We believe that, by not removing converted sites from its same property calculations, SUI is breaking widespread financial reporting norms and rendering its same property metrics almost meaningless as measures of organic growth.”

In that sentence, the author demonstrated that they simply do not have a clue.

If the author believes that statement, then the author does not know what the widespread financial reporting norms are for REITs.

It should be no surprise that Blue Orca specializes in shorting, not in REITs.

That might be why the fundamentals didn’t start (beyond the intro summary) until 19 pages into the report.

Allow me to state it clearly:

If SUI removed converted sites from same-property NOI as Blue Orca suggests:

- That would be breaking with financial reporting norms.

- That would render same-property NOI less meaningful.

The adjustments Blue Orca wants would have precisely the outcome they claim is happening. They want SUI to break financial reporting norms and report a less meaningful number.

I believe these adjustments were either suggested because:

- Blue Orca doesn’t know better or

- because their objective is to push the price down quickly.

The Market Ignores Blue Orca

The report was released yesterday.

On the day:

- Equity Lifestyle closed down 1.33%.

- Sun Communities closed down 1.16%.

SUI declined less than their largest peer, despite this bear attack.

Claimed Communication

Within the report, Blue Orca references private conversations with the company. There is no evidence such conversations even happened beyond Blue Orca’s assertions. If they did happen, there is no evidence about the contents of the actual communication. If they did happen, I can only imagine the frustration for the employee trying to explain things to a non-REIT expert looking for any way to negatively represent figures.

They also had communication with an unnamed source who supposedly worked for a competitor at some time in some capacity. How much credit do we give the anonymous source? I’m going with a goose egg.

My Assessment

I’m ignoring points 1,2, and 5 since they weren’t worth my time.

Looking at points 3 and 4, the author simply couldn’t support most of their claims with facts. Given the magnitude of the mistakes, it’s no surprise that the fundamental research was pushed so far back in the report. While there is a case for some small adjustments in SUI’s figures, competent analysts have already been making most of those adjustments for years. The biggest case they could support for any other adjustment would be the maintenance portion of capital expenditures at new acquisitions. However, that is only “inflating” AFFO by about 3%. Vastly less than the 48.4% inflation claimed by Blue Orca.

The fact that the company never explained things that are painfully obvious to experts in the sector is not a shortcoming on the part of the company. It isn’t their job to explain everything some bear with no sector expertise might not understand.

If someone told the analyst that recurring capex as a percentage of total capex is a trash metric, would they have understood?

In closing, I’ll quote Upton Sinclair:

“It is difficult to get a man to understand something when his salary depends upon his not understanding it.”

Disclosure: Long SUI.

Member discussion