ARE: Rejecting The Office REIT Comparison

Most of you already know Alexandria (ARE) was targeted by Jonathan Litt. Litt went on national TV and posted a brief summary of their argument. It’s already been dismissed by a few analysts, but it’s also one quite a few members have inquired about.

Summary

There are four points to address:

- Employees are spending less time in the office.

- New supply will be coming to market.

- Rental rates are related to supply and demand.

- Office REITs trade at lower multiples than ARE (a biotech lab REIT).

Based on these points, Litt believes ARE will see a significant decline in AFFO multiple and an increase in the market implied cap rate. Those are both ways of predicting a lower price.

I disagree.

I believe employers knew about their own policies when they signed leases. Despite those policies, they signed over 19 million square feet of new leases. On average, leasing spreads were great. Those spreads will probably dip because Q1 2023 set new all-time records for ARE. However, they should still generate healthy growth in FFO and AFFO per share. Because tenants are still committing hundreds of millions of dollars to new leases at higher rates, I am not convinced by the cell phone data.

What You Need to Know

Litt provides a few compelling points. He’s not an amateur in this area. He’s also already shorting the stock, so it’s in his interest to create worst-case scenarios. He’s also not required to disclose before he closes his positions. He has a vested interest in seeing the price decline and in generating customers for any services he provides.

Consequently, his argument also leaves out some extremely important factors.

Now we will go through those points line by line.

Point 1: Cell Phone Data Indicates Lower Employee Traffic

Litt’s argument is built primarily on cell phone data from purchased from placer.ai (a data service for cell phone tracking).

Before I dig in, I’ll admit that I’m not 100% convinced on the accuracy of this data. Tracking cell phones absolutely works. It must work for you to get a signal. However, I can’t see any way to verify the data that has been pooled.

If the data was flawed, the entire bear case would be thrown out. Therefore, we’re going to assume the data is perfect.

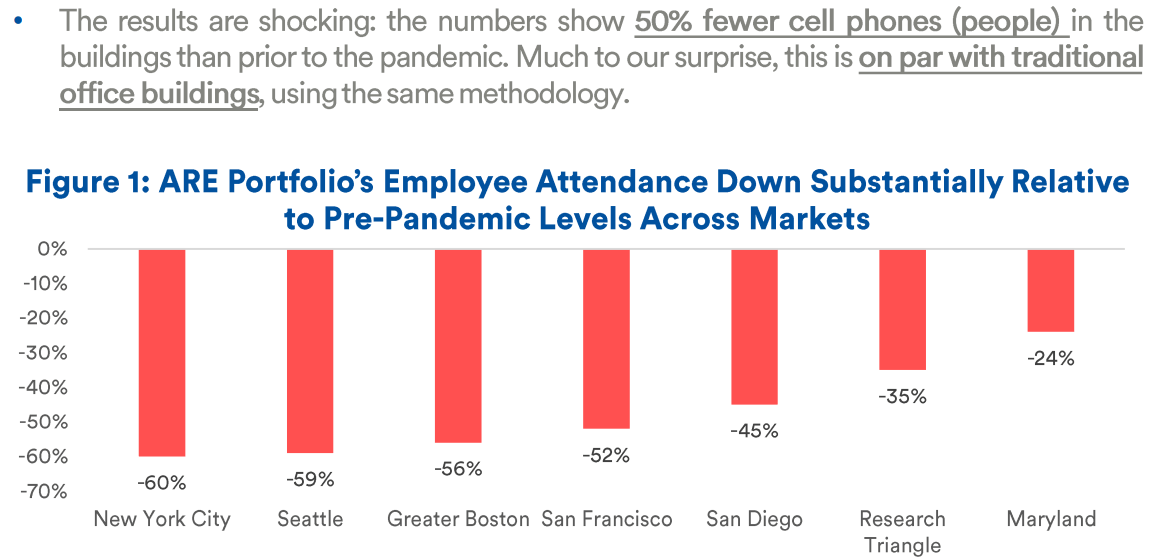

On average there are fewer people (cell phones) in the office:

Source: Litt’s Presentation

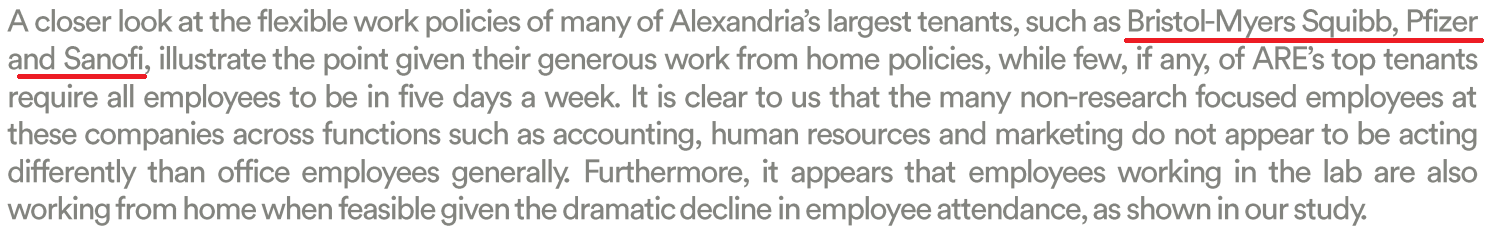

He goes on to highlight that many of the largest tenants have “generous work-from-home policies” which he sees as negative:

Source: Litt’s Presentation

Counterpoint 1: Tenants

It sure was nice of Mr. Litt to include the specific tenants who have generous work-from-home policies. Since those tenants have generous policies, it would be fair to assume that those tenants know they have generous policies. Right? Companies should usually know their own policies.

Those policies would also tend to date back to the pandemic, right?

That started in Q1 2020.

Therefore, those companies have had the policies for a few years.

Okay, so that begs the question.

Why did Bristol-Myers Squibb (their biggest tenant and the first tenant Litt mentioned) sign a new long-term lease in Q1 2022 (2 years after the pandemic) for a new group-up class A laboratory office flagship facility with 427,000 feet?

If they were going to cut back on their exposure, they probably wouldn’t be signing a new long-term lease for a huge new facility. Sure, some of the “office” work can be done from home. Not all. The lab is still needed, even if some of the support staff are telecommuting frequently.

Point 2: Supply

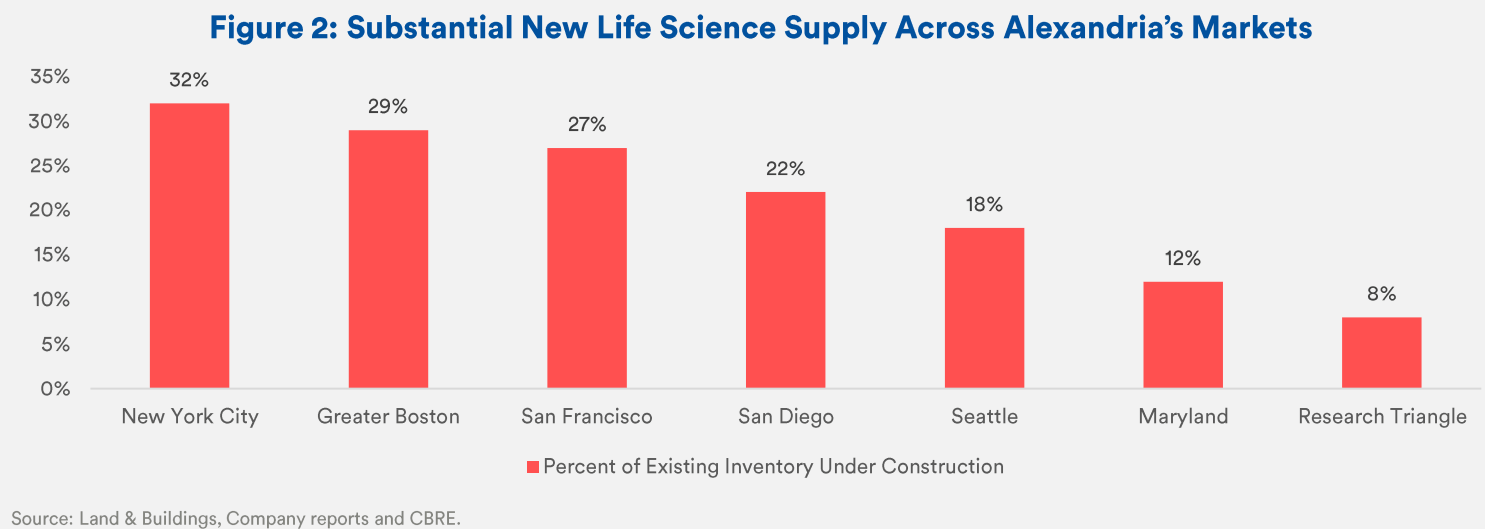

The next point, which is just kind of tossed in, is that there is more development underway.

Source: Litt’s Presentation

Counterpoint 2: Yeah, We Know

Projects had a long lead time. Lately, it was a very long lead time. ARE discussed it on their calls. There were more barriers to construction. More shortages on necessary parts. Consequently, there is a bigger lead time between when development started and when it would be finished.

Many of the projects were approved and started when interest rates were under 1% and the Federal Reserve was calling inflation “transitory”. Demand was expected to be higher because at that point the Federal Reserve was indicating they would not create a recession.

As it stands, ARE is one of the major developers in this space. They have quite a few properties to deliver over the next 3 years. Those new properties that are not yet ready are already 74% leased or under negotiation:

What if you don’t trust the leases that are under negotiation? You’d still have 72% leased. Regardless, by the time they label something as “negotiating”, the vast majority of those deals should close.

While deliveries (completion of new biotech lab space) are expected to be elevated over the next few years, there’s also a reduction in new development projects being approved. Since lab space demand is still growing, as evidenced by new leases, that supply should eventually be gobbled up.

Point 3: Rental Rates Hit by Supply and Demand

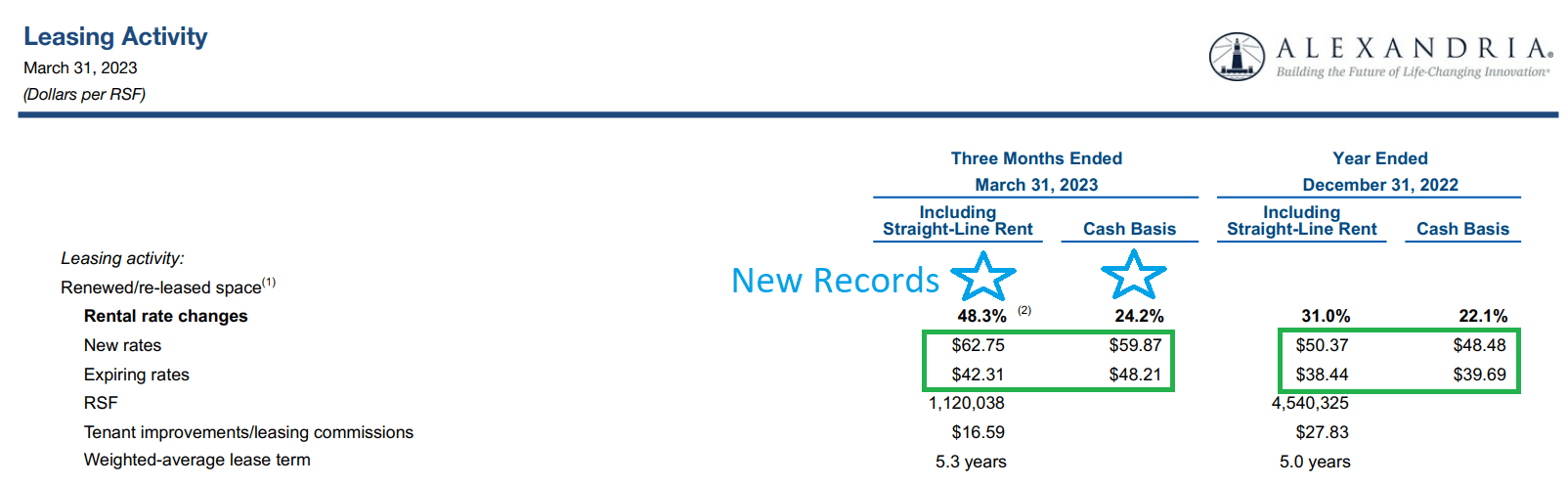

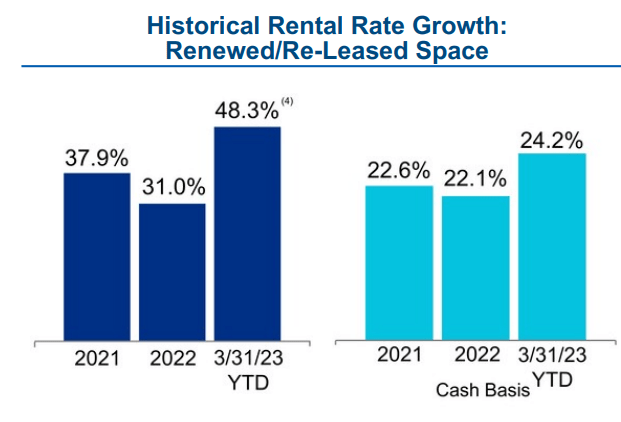

The reason he argues about supply and demand is that it would impact rental rates. So, what rates did ARE achieve lately on leases signed with real tenants?

Those are excellent.

Did things just happen to go right in the first quarter, or has ARE been getting strong spreads on leasing for the last few years?

That’s really good. Those are solid leasing spreads. What do those years have in common?

- Nice spreads.

- All happened after the pandemic and the shift to working from home.

Could it be that there is a terrible secret hiding in all this?

Maybe ARE barely leased any space and just got high rents on the space?

That could fit with Litt’s argument when he said:

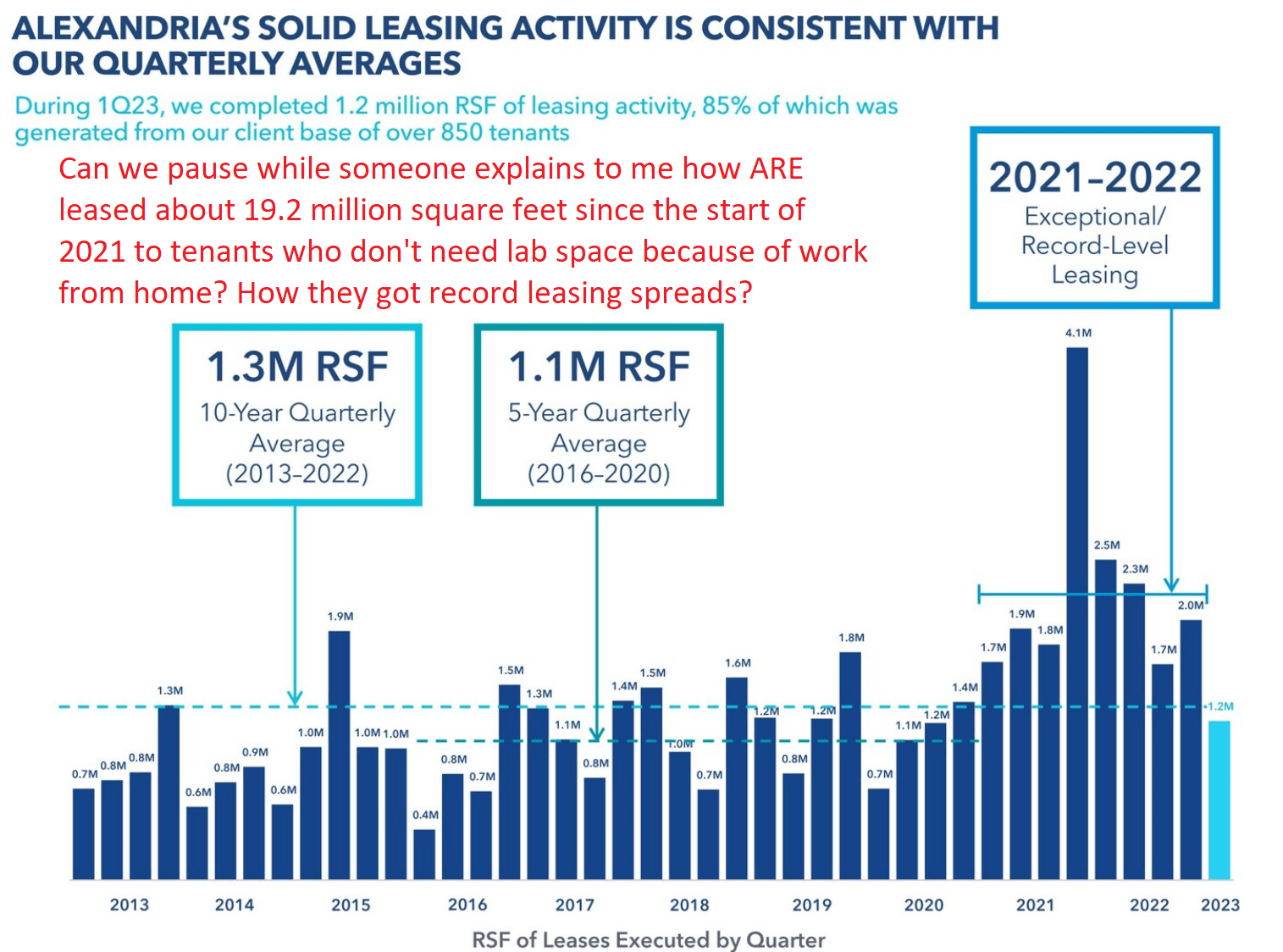

Alexandria’s leasing volumes declined 50% year-over-year in the first quarter of 2023 according to company filings.

Just to be certain though, we better find a chart for leasing volume by quarter:

Well, I guess it wasn’t low leasing volumes. Leasing volume in Q1 2023 was down primarily because the year-over-year comparison was so high.

Now, as you probably imagine, office leasing spreads don’t look great. Office cash spreads probably were not over 20% year-to-date, or for 2022, or for 2021.

Let’s just check to verify.

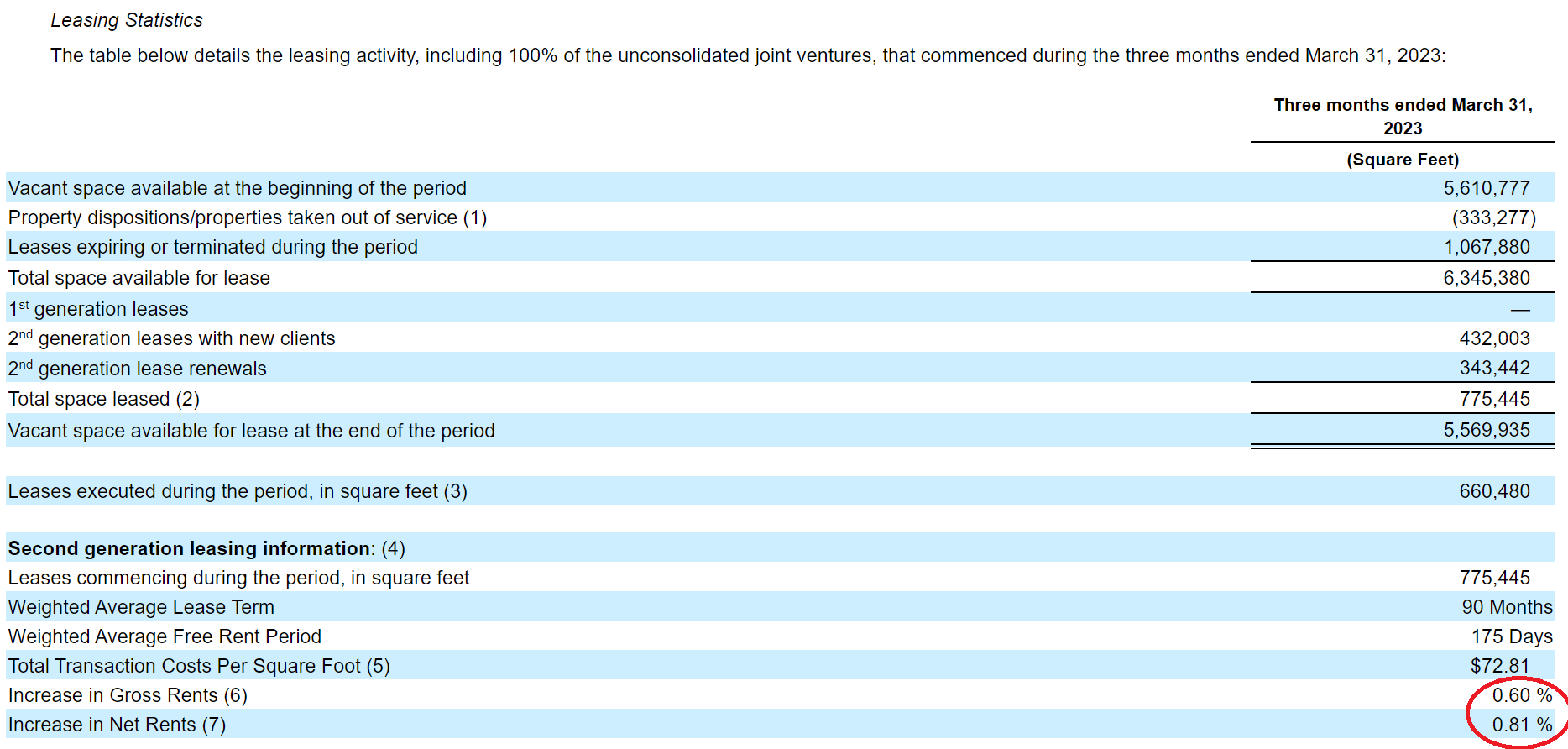

Hey Boston Properties Trust (BXP), can I get a slide from the BXP Q1 2023 investor presentation with your leasing spreads? No? 93 pages and I don’t get that image? Okay, time to pull the BXP 10-Q for Q1 2023. We found the leasing spreads:

The office REITs refer to these spreads as “second-generation leasing”.

I’ll just go ahead and label that as “not great”.

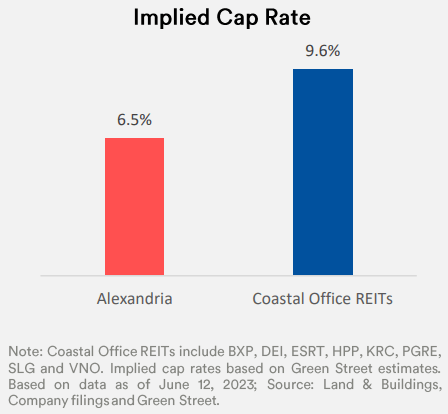

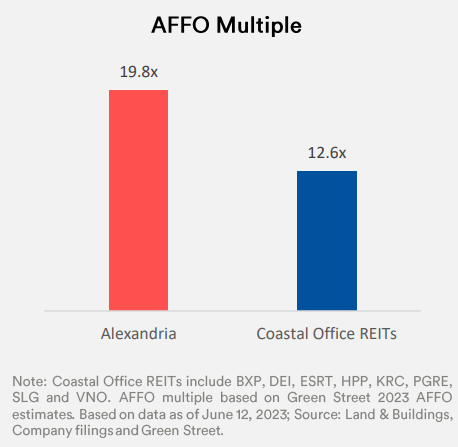

Point 4: Office REITs Trade at Lower Multiples

If ARE was valued like an office REIT, then Mr. Litt would make a bunch of money from his short position. Cool.

As we’ve already demonstrated, ARE has been very successful in signing leases for tens of millions of square feet. They achieved strong spreads on those leases, despite the tenants already having work-from-home policies in place. ARE did that. Office did not.

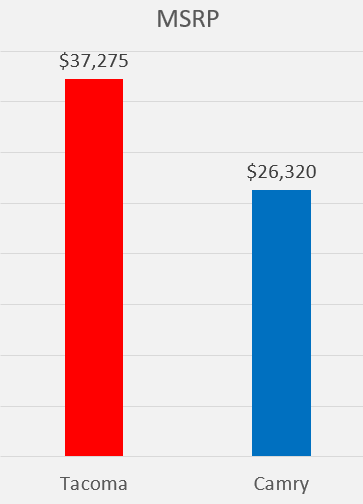

Counterpoint 4: Toyota and Camry

Since Mr. Litt decided to compare two things that are obviously not the same, I’ll do it also:

As you can see, the MSRP of a Tacoma is higher than the MSRP of a Camry. If a Tacoma were to fall to the price of a Camry, it would be a big move.

Ignoring the difference in leasing performance between ARE and office REITs is just as silly as ignoring the differences between these vehicles.

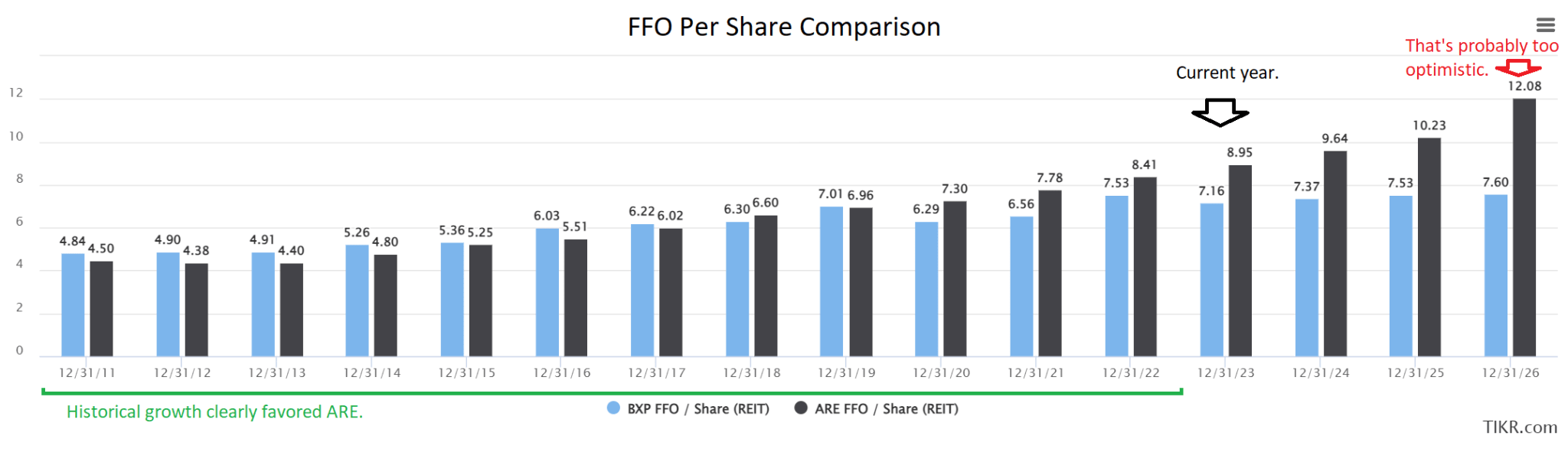

You can see the difference in performance by simply comparing the FFO per share over the prior years and the projected growth rates:

ARE demonstrated a much better compound annual growth rate and they are forecast to continue growing. BXP had a lower growth rate and expectations indicate fairly low growth. Therefore, you would expect the REITs to trade at different multiples.

I want to go one step further though. Litt’s data was listed as being for June 12th, 2023. Rather than using consensus estimates for AFFO, they used only one estimate. Based on the closing price of $121 for that day and the 19.8x multiple in Litt’s charts, the estimate had to be about $6.11.

Here are a few quick numbers:

- The 2023 AFFO estimate Litt used: $6.11

- Consensus 2023 AFFO estimate: $6.97

- Forward AFFO estimate: $7.07

Using $6.11 as the estimate made ARE look more expensive.

At today’s price of $112.81:

- Consensus AFFO multiple: 16.18x

- Forward AFFO multiple: 15.96x

Since ARE is still growing FFO and AFFO per share and office REITs are struggling, a bear would want to use the oldest data possible and aim for a low estimate.

Conclusion

The cell phone data sounds concerning. Until you look at the leasing data. These tenants already knew about their own policies when they signed those leases. Despite many tenants already having work-from-home policies, they still signed leases with ARE covering over 19.2 million square feet since the start of 2021. That includes new leases to top tenants who are considered to have “generous” work-from-home policies.

It isn’t realistic to lump ARE in with office REITs, given that office REITs have not demonstrated exceptional leasing spreads. Once we separate ARE from office REITs, we’re left with the argument that different things have different prices. That’s true, but not insightful.

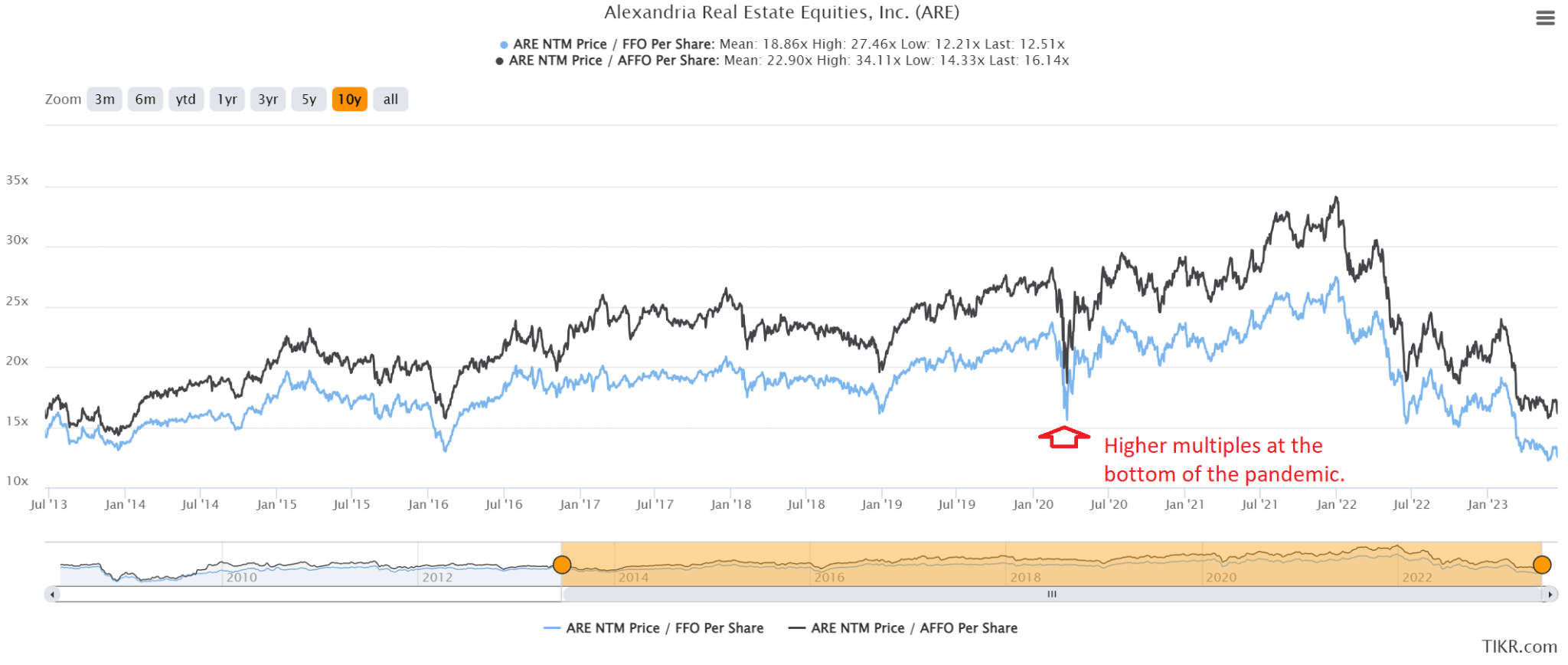

Using FFO or AFFO per share, ARE is pretty close to the lowest multiples seen in the last decade:

We believe ARE is a bargain at $112.09 (current price). This is a good choice for long-term investors as the REIT does an excellent job of producing long-term growth in FFO and AFFO per share, as well as NAV per share.

Growth in FFO and AFFO per share leads to dividend growth. ARE has a dividend yield of about 4.4% and their dividend is easily covered by AFFO. Sure, the dividend yield is lower than short-term Treasury rates. However, the dividend also benefits from frequent increases.

Disclosure: Long ARE.

Member discussion