ARE: Recent Asset Sales Demonstrate Prudent Management

- ARE’s management is delivering. The REIT had billions of development to fund.

- Rather than issuing equity, ARE is selling off existing properties and recycling the capital.

- When those new assets are finished, they become accretive to AFFO per share.

- Property sales reinforce that ARE’s lab portfolio trades at much tighter cap rates than generic “office” properties.

- The recipe is simple. Sell assets at reasonable cap rates. Use proceeds to develop properties at higher cap rates. Do not issue equity at low prices.

We recently demonstrated why we were rejecting the office REIT comparison.

Next bear thesis:

Is Alexandria (ARE) overvalued based on implied cap rates? (Spoiler: No)

Jonathan Litt (the shorter seller) states that the implied cap rate was 6.5% based on data from June 12th, 2023. The share price was $121 at that point. Today, it is $112. Therefore, the implied cap rate is even higher.

ARE’s portfolio commands a lower cap rate.

ARE Strikes Back

I can’t help but appreciate the timing for ARE’s recent press release. The only weakness is that it could’ve been organized a bit better (Tables? Bullet points? Please?). Weak organization is typical for all companies.

The main points are:

- ARE sold 5 properties for in the Greater Boston market for $365 million.

- The sale carries a 5.2% weighted-average cap rate (much lower than the 6.5% rate implied at $121).

- ARE now has $884 million year-to-date in property sales that are completed or pending (as of 6/27/2023).

- Proceeds will be used to fund existing development projects, just like the company planned.

A bear might point to the fact that ARE’s cap rate of 5.2% on the transaction states that it: “includes vacancy available for redevelopment”.

What if ARE was including a bunch of vacant space to drive the cap rate down?

We’re going to proactively verify that these transactions look like a reasonable representation of ARE’s portfolio. ARE does an outstanding job of providing property-level transparency. One of the most important tools for fighting off a bear attack is transparency, and we’re going to utilize it here.

First, here is the weighted-average occupancy:

Overall, ARE’s operating properties in North America had a 93.6% occupancy rate. These properties were a little bit higher. ARE did not throw vacant property in to create a lower cap rate.

This looks good.

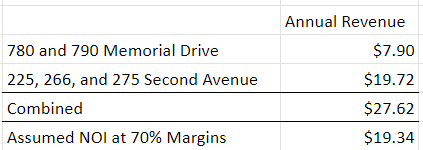

The cap rate of 5.2% on a $365 million transaction implies that annualized net operating income was about $18.98 million. That’s pretty similar to what we would forecast if we just looked at the annual rent (yes, ARE provides that data) and applied 70% margins.

Note: Values in millions of USD.

Once again, I see nothing to worry about here. ARE is executing on its plan precisely as it laid the plan out for shareholders. The transparency provided by ARE allowed us to verify that.

Why would ARE trade at the 9.6% implied cap rate for office properties when the properties are actually selling at a 5.2% cap rate?

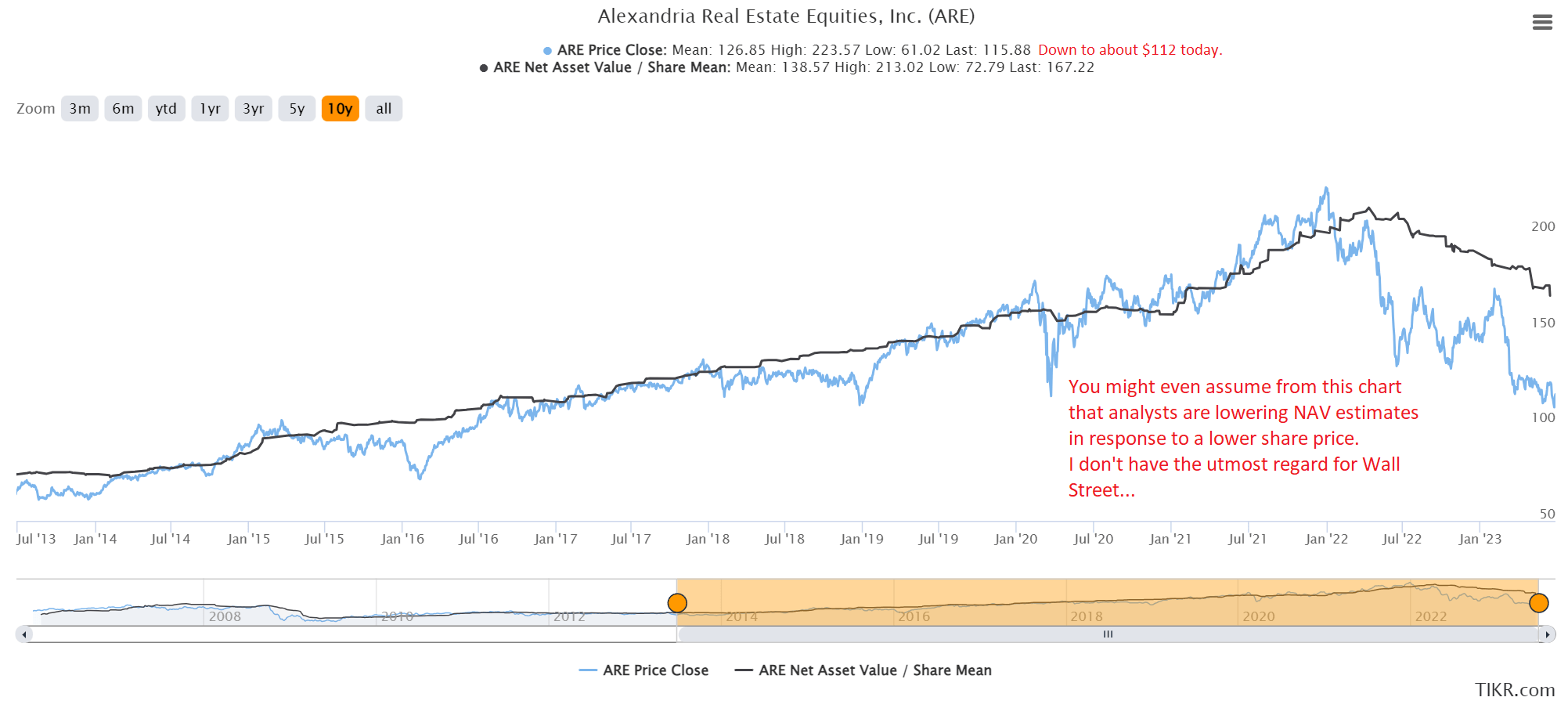

If you find the implied cap rates and NAV estimates useful, you may find it interesting that ARE has often traded above consensus estimates for NAV. However, consensus NAV estimates are really just averaging estimates from a handful of analysts. Useful, but not gospel.

Here’s the chart:

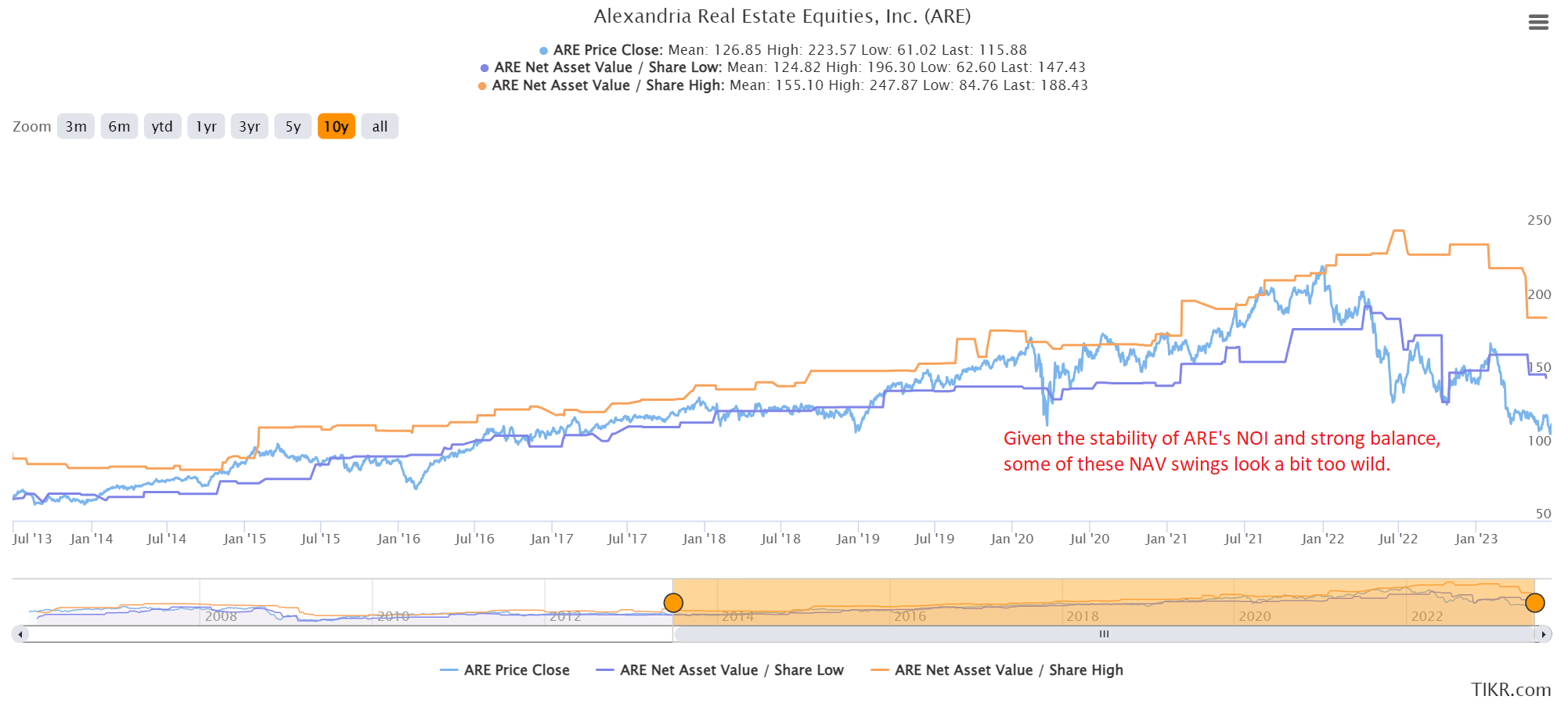

How about charting it with the highest and lowest estimates?

Yeah, some of those swings are really abrupt. On the other hand, the lowest estimate available is $147.43. So, there was not a single analyst on Wall Street who believes these properties actually trade at an absurdly high cap rate.

Why Do Office Properties Have High Cap Rates?

Pressure on Net Operating Income. When existing leases for office real estate expire, many will go vacant, require massive amounts of capital expenditures, or lease at much lower rates. The cap rate is high because the current NOI is still high.

Will ARE be unable to lease their properties? Probably not. Their leasing results suggest they are doing great.

Selling Another Asset

While some REITs like Digital Realty (DLR) are only disposing of a small volume of assets, ARE just sold another property for $155 million. It’s only been a week since the prior sale (analyzed in this article).

If we want to be more specific, they sold part of a building. They sold 268,000 square feet out of a 660,034 square foot building. Proceeds will be used to fund the development pipeline. This is exactly how a REIT like ARE (frequent developer) should fund construction.

If shares were $180 or $200, they should issue equity to fund development. Record high was around $225.

With shares at $112, they should keep unloading these assets because it is the cheapest source of capital by a healthy margin. Well done.

Thanks for reading, and have a great fourth of July.

Member discussion