Apartment REITs Surge on Blackstone Buyout of AIRC

Apartment Income REIT (AIRC) $AIRC surged today following the announcement of a buyout by Blackstone.

Note: AIRC is also known as “Air Communities”.

The deal pushed most housing REITs (especially apartment REITs) higher on the day.

The rally came despite a slight increase in Treasury rates across most of the yield curve.

The gain was most pronounced among apartment REITs with the “Sun Belt” apartment REITs getting the biggest benefits.

Valuation

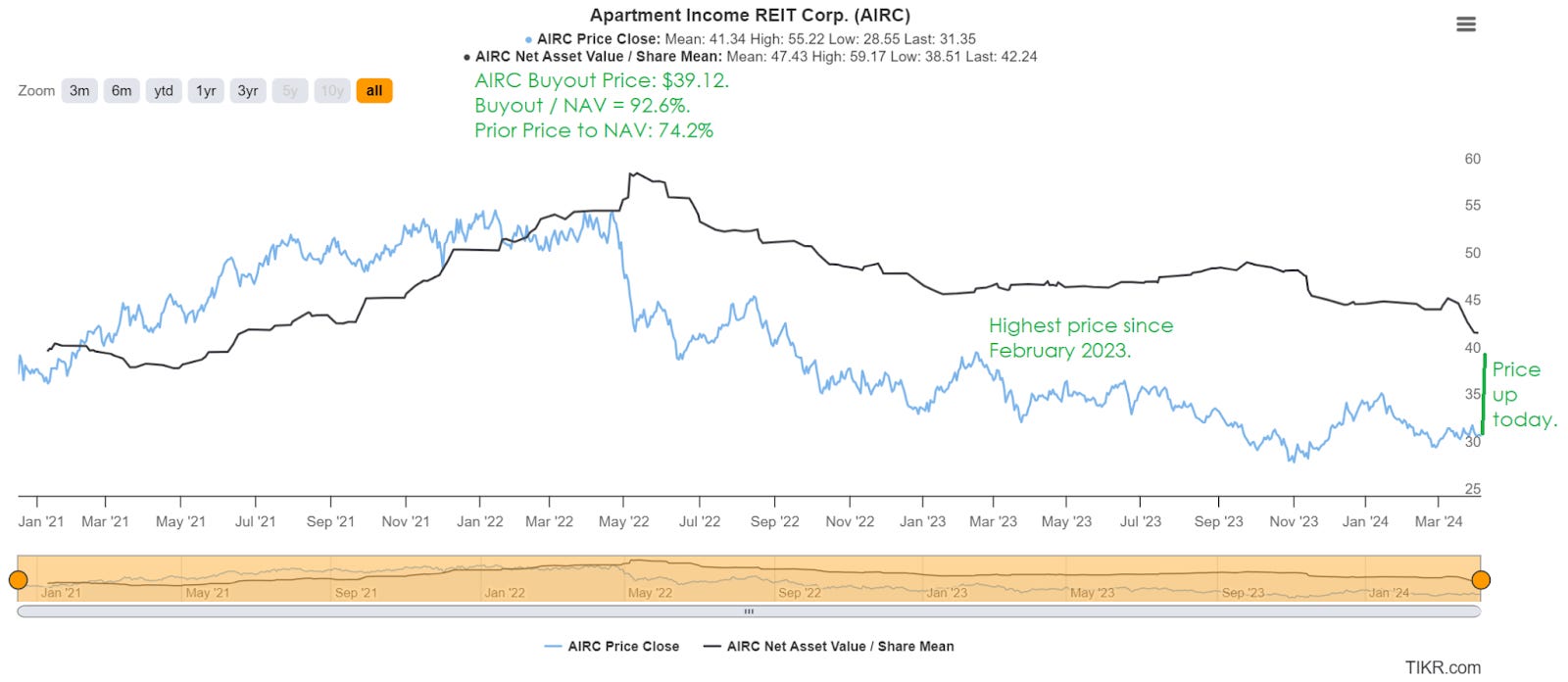

The deal has Blackstone acquiring AIRC at $39.12. That price is:

- A huge premium (24.8%) to AIRC’s prior closing price of $31.35.

- 92.6% of the consensus NAV estimate ($42.24).

See the comparison in the chart below:

Source: TIKR.com

Blackstone gets a few benefits:

- They are buying the REIT below NAV.

- The REIT still has some debt locked in with a 4.3% weighted-average rate and 6.5 year weighted-average maturity.

That’s not a really cheap weighted-average rate compared to some REITs, but it is still cheaper than the financing available in the market today. Overall, this deal looks beneficial to investors on both sides. However, it also reminds the market that these apartment REITs do still have value.

Since many of them have been trading at material discounts to NAV, that can be enough to provide some support for values.

When Blackstone decides the AIRC portfolio is worth more than $9 billion (including the assumption of debt), it can give investors more confidence.

A few of the apartment REITs:

- AvalonBay (AVB) up 2.82%.

- Equity Residential (EQR) up 3.25%.

- Essex Property Trust (ESS) up 2.45%.

- UDR (UDR) up 3.07%.

- Mid-America Apartment Communities (MAA) up 4.42%.

- Camden Property Trust (CPT) up 5.7%.

- Independence Realty Trust (IRT) up 6.0%.

Among the apartment REITs, we are long AVB and CPT.

We are also long two manufactured home park REITs:

- Sun Communities (SUI) up 2.56%

- Equity Lifestyle (ELS) up 1.37%.

AIRC had one of the largest discounts to NAV, so there was more room for a deal that would benefit existing shareholders (who can redeploy) while giving Blackstone a bargain price.

Fundamentals

This doesn’t change the fundamentals. No impact to our predictions or targets. Seemed like investors may want to know why apartment REITs were surging today though.

It is worth recognizing that many REITs trade at discounts to consensus NAV estimates following the increase in interest rates over the last two years. That’s a nice benefit for investors in the sector.

Disclosure: Long AVB, CPT, SUI, ELS.

Member discussion