AMT Q2 2024: The Crowd Goes Wild

The crowd is going wild for American Tower (AMT).

This is just the kind of quarter to get people hyped.

Can I say that when AMT still trades at a fairly reasonable valuation?

Not as cheap as some peers, but certainly not a bad deal.

Any Buybacks?

Not yet. Management referenced the possibility of allocating some capital to buybacks later.

Investors Loving Guidance

Year-over-year, the numbers look. That’s partially driven by some non-recurring factors enhancing the results.

Remember how investors were not particularly excited about SBA Communications (SBAC)? In early trading, they were roughly flat. AMT was up around 3% and closed the day (yesterday) up 3.78%.

Would you believe that the change in guidance for the REITs was actually pretty similar?

I know, I know, that sounds wild.

- SBAC was reducing good numbers like revenue, adjusted EBITDA, and AFFO.

- AMT was increasing those good numbers.

How could I suggest that the two REITs actually had similar updates?

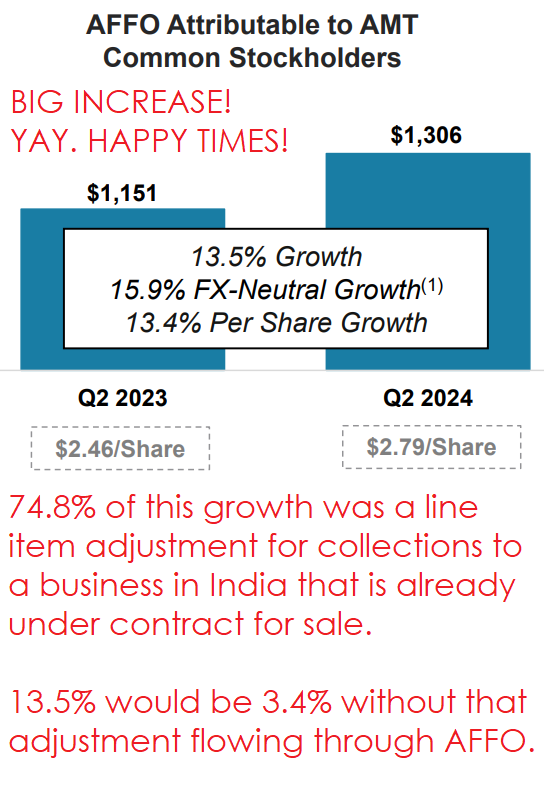

Let’s start with AFFO’s monstrous growth in AFFO:

Source: AMT

So nearly 75% of the increase was actually a non-recurring adjustment.

Should that really flow through AFFO?

That depends on how you want to define AFFO. I’m going to just say “no”.

In prior periods, due to lower expected collections, AMT reduced their reported AFFO per share.

Reducing AFFO in those years made AMT look bad, but they were not.

In 2024, AMT has been reversing those adjustments. That makes this year look better than it is.

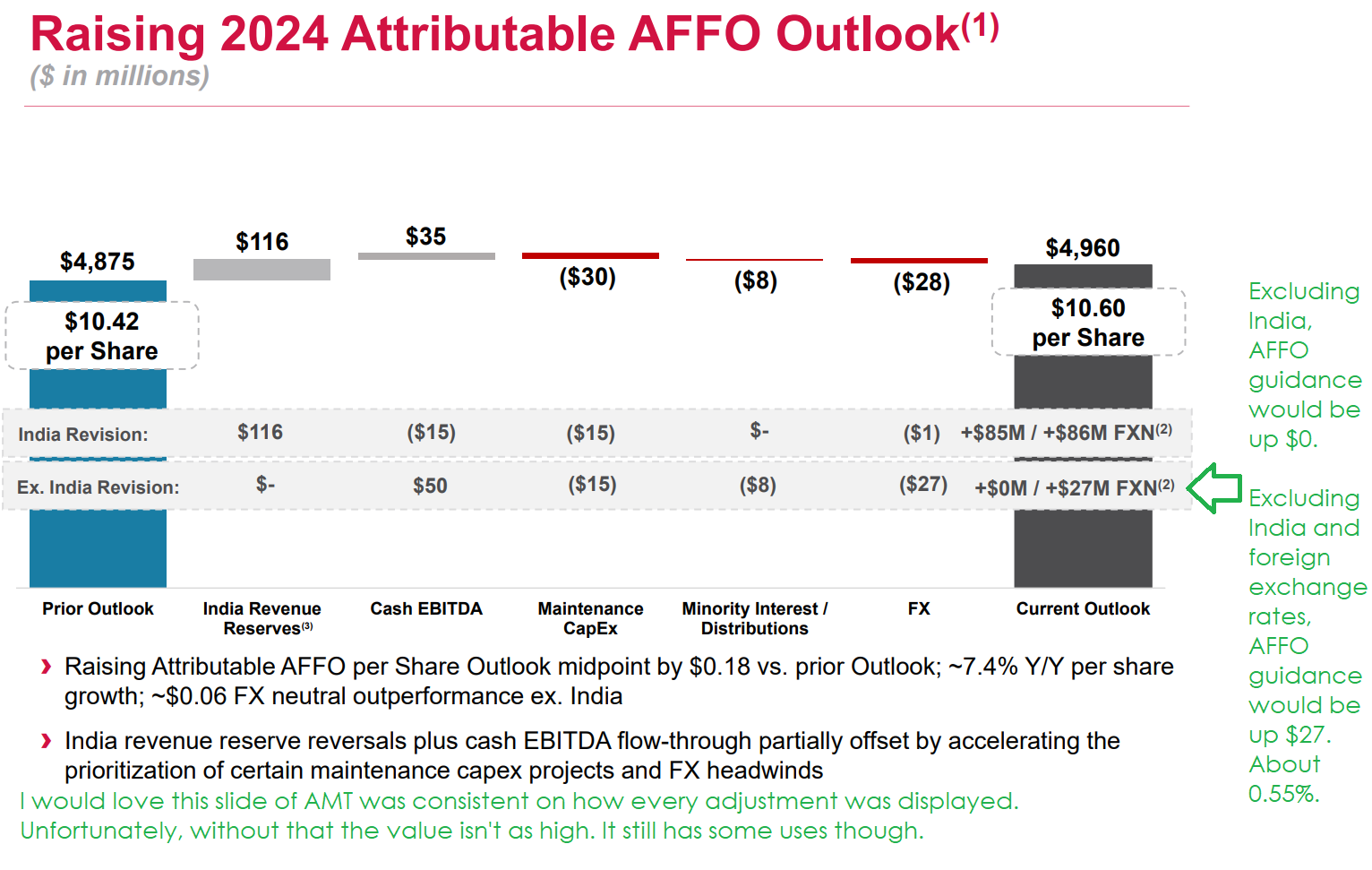

We can really drill into the impact of those adjustments with this slide:

Source: AMT

I want to be clear about the accounting adjustments:

- The adjustments related to India reduced AFFO in other periods.

- The reversal of adjustments is enhancing AFFO in 2024.

We refused to punish AMT when those adjustments were hurting AFFO.

We refuse to reward AMT for the reversals.

Please don’t get me wrong. The reversals do have value. For instance, the India reversal is reflected as $116 million. That comes out to about $.25 per share.

How much is $.25 per share worth? It’s worth about $.25.

What you absolutely should not do is value it as part of AFFO and hit with a 20x multiple.

- Correct: Valuing $.25 per share of bad debt collects as $.25 of extra cash.

- Wrong: Valuing $.25 per share of bad debt collections as part of AFFO and applying a multiple of 20x for a value of $5.00.

This is not a recurring stream of revenue.

Okay, look, some people still don’t get it. Let me break it down further.

- Let’s say some deadbeat owes you around $116.

- You tell your family that you probably won’t be able to collect.

- You pressure that deadbeat and he gives you $116.

How much is that worth? It’s $116 and a good feeling.

How much did it increase your income next year? It did not. You could invest that $116, but you’re not collecting $116 from that guy again next year.

Not unless he develops a memory problem and you develop an ethics problem. In this scenario, those events are not allowed.

The market has a tendency to react to these adjustments as if they are recurring, even though they explicitly are not recurring.

Currency Neutral Normalized AFFO Per Share Guidance Adjustments

If we remove the foreign exchange impacts and remove the benefit from collections in India:

AMT’s AFFO guidance would be up about 0.55%.

SBAC’s AFFO guidance would be up 0.59%

Note: Neither REIT was repurchasing shares during the sector, so the impact on AFFO guidance and AFFO per share guidance should be the same.

I skipped past the “per share” metric here to reduce rounding errors.

To be fair, AMT did this while adding more maintenance capex (which drags AFFO lower).

Because AMT also overcame the adjustment to their maintenance capital expenditures schedule, I would give them a tiny edge here.

Randomly Stomping on Digital Realty

During the earnings call, AMT decided to highlight that CoreSite (their data center REIT) was leading the way in returns on invested capital:

“Next, CoreSite executed another exceptionally strong quarter with double-digit revenue growth, their second highest quarter of signed new leasing in the company's history, and record cash backlog. Additionally, our data center projects currently under development are roughly 60% pre-leased, four times the historical average, providing confidence and visibility to an accelerated pathway to realizing CoreSite's best-in-class returns on invested capital.”

Growth CapEx

It’s worth noting that AMT is investing quite heavily in data center development.

For 2024, the REIT has about $1.4 billion of planned growth (or discretionary) capital expenditures.

That is different from “maintenance”, which is just keeping your properties in shape.

During Q2 2024, 8.1% of AMT’s revenue came from data centers.

However, 34% of AMT’s budget for growth capital expenditures is allocated to data centers.

Why is that happening?

Historically, towers have been a better asset class.

A big factor here is probably that AMT can achieve materially higher yields on development capital expenditures for data center construction than they can with any other investment (within reason). Because AMT is designing new data centers, they are building them based on the current and projected future needs of their customers.

Many older data centers remain at least partially vacant (hey DLR) because they don’t meet the needs of today’s growing customers and retrofitting them would be extremely expensive.

More Data Centers Commentary?

I have clearly given AMT more credit than DLR.

With AMT’s data center REIT, they are building new data centers to meet the needs of today’s customers.

They are not held back by a portfolio of outdated assets.

The returns on data center development are so attractive that Realty Income (O) invested in a deal with DLR.

Realty Income took an 80% interest in the two data centers under development. Thanks to Realty Income for the transparency on development. Realty Income stated their investment should have an initial 6.9% cash yield, 10-year lease, 2.0% annual escalators, and an investment grade tenant.

You probably know this already, but Realty Income isn’t usually very active in the development market. They buy real estate that already exists.

Does anyone think Realty Income didn’t have the choice to buy some outdated partially vacant husk? Of course they did. But they felt it would be a better return of their capital if they were developing instead.

Prologis (PLD) is the world’s biggest industrial REIT. PLD has extensive expertise in development and decided they could make money off developing data centers also.

That means AMT, O, and PLD all decided to invest capital in the data center space and all decided that new development was the way to go.

Extrapolating on Cash Yields

Given the cash yield for Realty Income on the development, you can reasonably project that American Tower can achieve similar yields on development. They have their own data center REIT focused on development instead of having to work with DLR. The strong yields on development continue to drive massive global investments in data center construction.

These yields make investments in the data centers accretive to AFFO per share (upon the data center being leased).

Cash Yield Comparison

Towers in developed markets like North America and Europe trade at cap rates that are substantially lower than 6.9%.

Towers offer attractive growth rates with minimal maintenance capex. Those are both very attractive features, which result in the towers deserving low cap rates.

The challenge here is that data centers don’t have particularly high rent escalators. They tend to be pretty low. Realty Income’s deal at 2.0% is pretty good.

Using the 2.0% example from Realty Income, these properties should exhibit slower revenue growth than towers in developed markets.

So AMT gets a better cash yield on development, but a slower growth rate in the yield.

However, AMT believes the investments in data centers can work along with their tower infrastructure by offering better solutions for customers. They see the data centers as potentially creating a competitive advantage that can make their towers even more attractive. If AMT succeeds, then the data center business creates a synergy that makes the overall investment better.

Tower Commentary

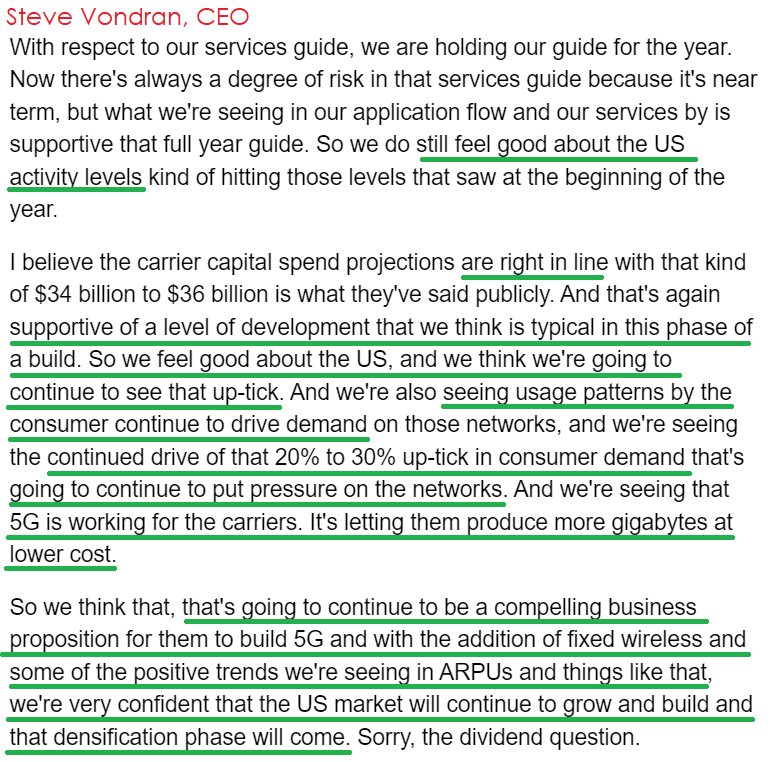

On the earnings call, management sounded positive.

This is part of the Q&A section:

Source: Seeking Alpha

The dividend part actually gets picked up by the CFO in the next section.

Dividend Commentary

Regarding the dividend, management said:

Source: Seeking Alpha

This is a point I’ve frequently tried to tell investors about. The growth in AFFO is critical to the growth in dividends. Dividend growth without AFFO growth is fool’s gold. Eventually, it will be eroded. But AMT often delivers solid growth in AFFO per share. Unfortunately, sometimes the AFFO per share can be a bit distorted between years by the inclusion of non-recurring factors.

Conclusion

This was a good quarter. It wasn’t anything that should shock investors. The magnitude of the recovery on the bad debt was impressive, but that only adds about $.25 per share in value.

It isn’t repeatable. Including it in AFFO exaggerates the growth rate from 2023 to 2024 and negatively impacts the growth rate from 2024 to 2025.

I’ll give AMT credit for the fact that guidance overcame an increase in maintenance capital expenditures and credit for the additional recovery from India.

However, I’m not going to multiply the value of the cash they are collecting from India. That’s a non-recurring revenue.

Consequently, we have a tiny adjustment at 0.2%.

It's remarkable how similar the quarters were for AMT and SBAC, yet investors were far more impressed with AMT thanks to the non-recurring items included in AFFO.

Disclosure: Long AMT, SBAC, CCI.

Member discussion