Alexandria Shines With Q1 Beat

Alexandria (ARE) just reported Q1 2024 results.

- FFO as adjusted was $2.35. Beat consensus estimates of $2.33.

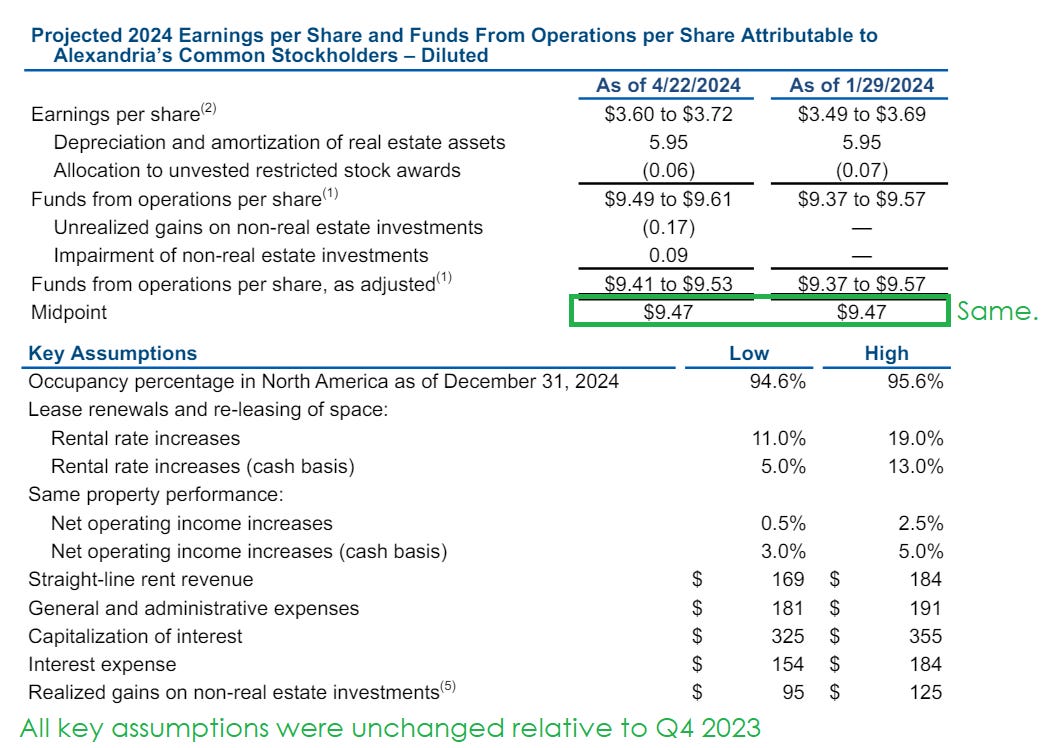

- Full year guidance narrowed to $9.41 to $9.53.

- Guidance midpoint $9.47. Same as before.

- Consensus estimate is $9.48.

It’s common for the consensus estimate to be a tiny bit above the midpoint of guidance.

Leasing Spreads

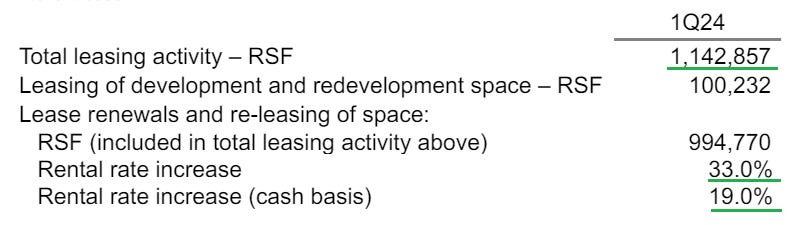

Leasing spreads looked great. I combined part of the Q1 2024 and Q4 2023 presentation to create this comparison:

They leased a bit more in Q1 2024 than their average quarterly volume from 2023.

Those spreads were good, once again:

I want to point out that the strong spreads in Q1 2024 are not expected to reflect the entire year.

Guidance included an expectation of GAAP spreads at 11% to 19% (vs. 33% in Q1) and cash spreads at 5% to 13% (vs 19% in Q1).

So those spreads should be materially smaller in subsequent quarters to bring the average down.

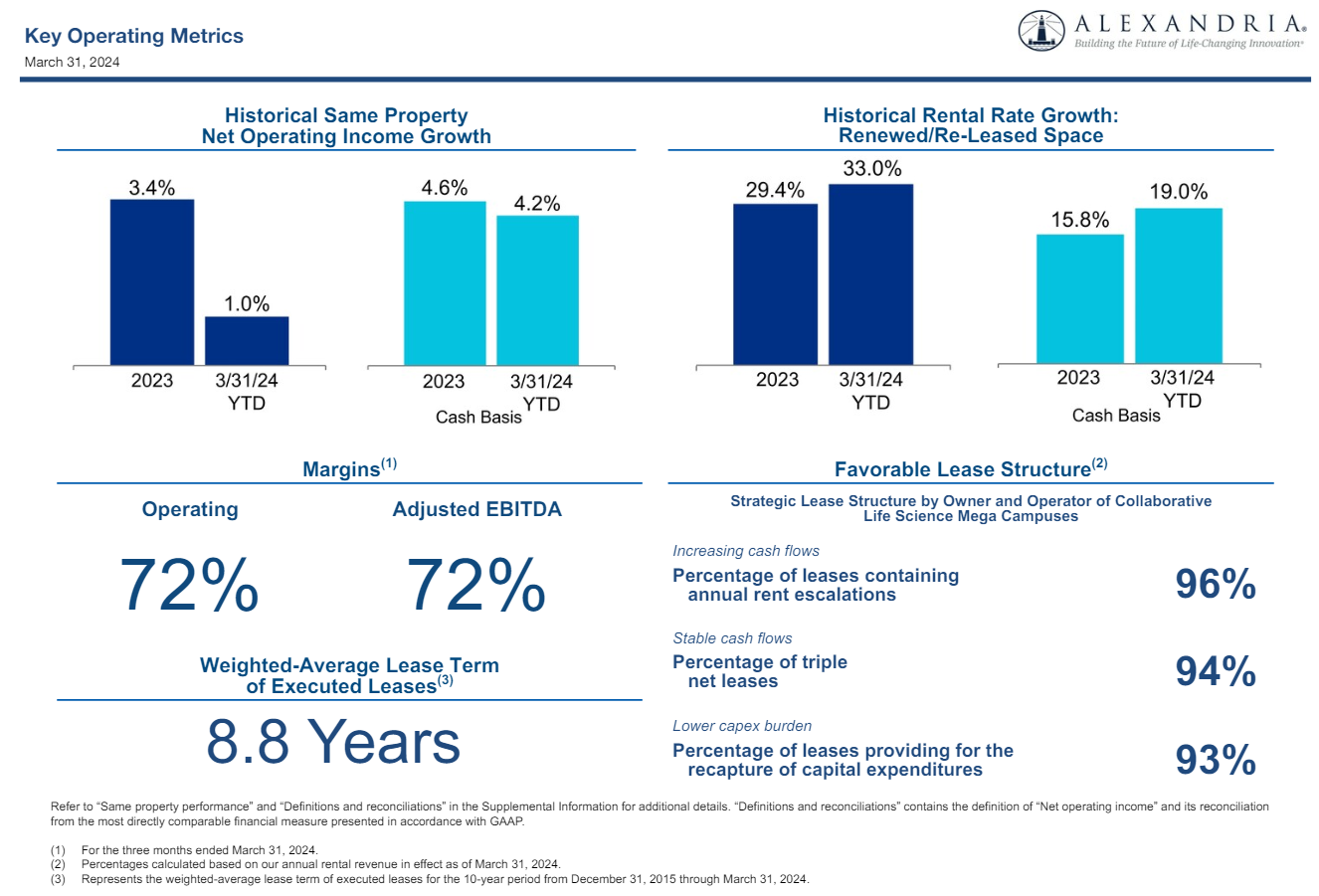

I would also note that cash SS NOI continues to do quite well: 4.2% year-to-date.

Management forecasts 3% to 5% for the year.

Occupancy and Rent Collections

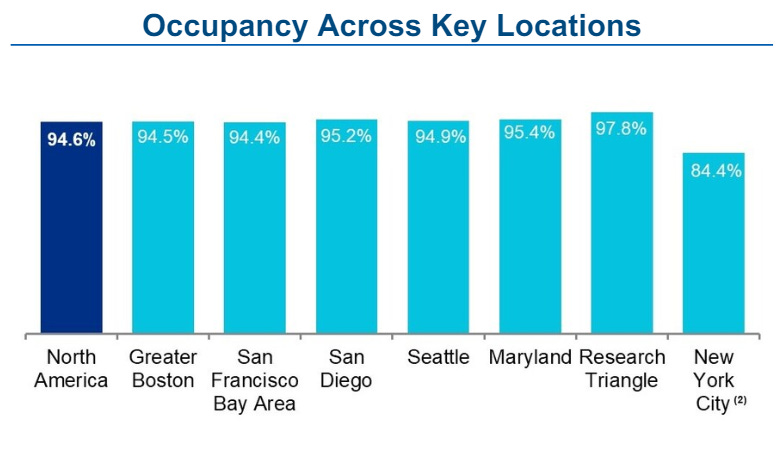

ARE is doing well at maintaining occupancy as they push leasing spreads.

- Occupancy for operating properties in North America was stable at 94.6%.

Vacancy is primarily in New York City:

Issuance of Debt and Not Equity

ARE issued $1 billion bonds during the quarter:

- $400 million at 5.25% due 2036.

- $600 million at 5.625% due 2054.

The ATM (at-the-market) program became inactive after expiring.

ARE opened a new ATM program, but didn’t issue shares.

Great. What is there to dislike? If you’re certain rates are going to fall, then you might not like the duration of the debt.

Otherwise, there’s nothing to dislike.

Given the pressure some REITs have seen from rising rates, I see nothing wrong with ARE continuing to lock in their rate on debt.

ARE’s average rate on debt isn’t as low as some peers. But that’s actually positive when it comes to FFO growth.

The headwind for ARE from higher rates is smaller.

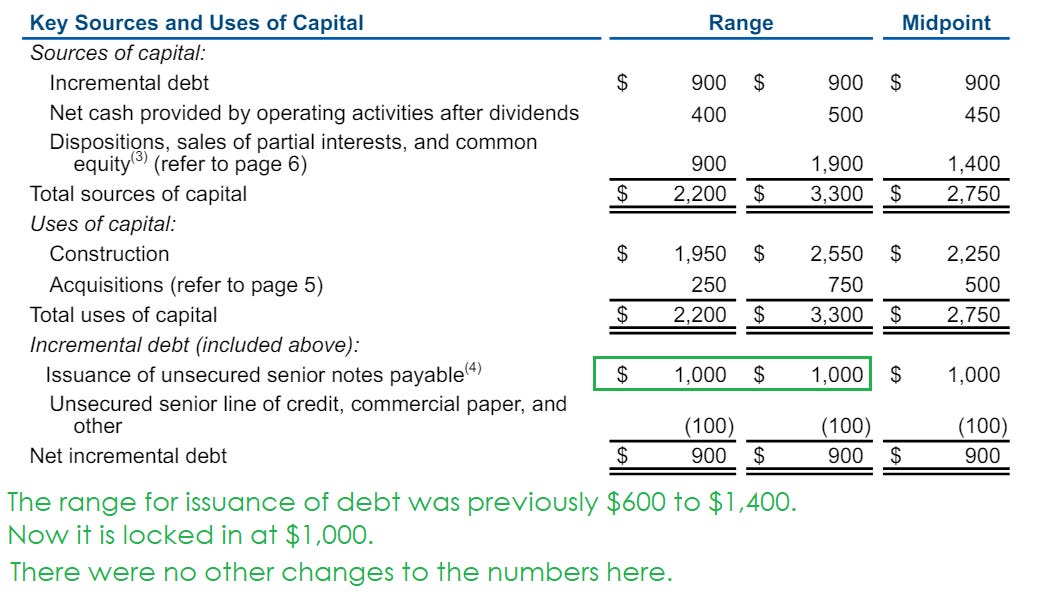

Capital Plans

Since ARE develops a large amount of real estate, having a clear plan for where they are going to get cash is particularly important.

I checked ARE’s updated plan for cash:

Only one change. It was locking in the debt amount.

You don’t see issuing shares on that plan. Current prices just aren’t favorable for it. At the right price, sure it would make sense to issue equity. They just don’t have that price.

Therefore, the most prudent way to fund development is dispositions.

Sure enough, dispositions are the biggest source of cash.

Another $450 million comes from retained cash after dividends.

Conclusion

Looks like a pretty good quarter.

There could still be surprises on the earnings call.

My first impression is positive though. Looks like ARE is continuing to perform well.

Member discussion