Alexandria Q4 2024 Update: The Buybacks Begin

Alexandria Real Estate (ARE) reported Q4 2024 results after the market closed. No summary. Article is only around 700 words.

Note: For our new members, this is the website release. This is what it looks like we when we have a new article on our website. You get a beautiful email delivery.

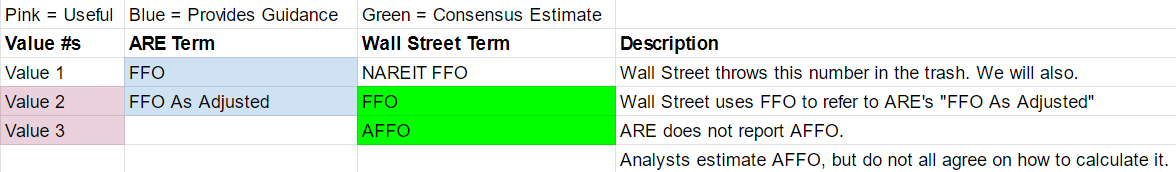

Wall Street’s Definitions for FFO (Repeated for ARE)

Words are bad. They are imprecise. I used to explain the differences in words. I hated it.

I built a chart to explain the concept.

There are only 3 types of values, but there are 5 terms. I’m counting “FFO” as two terms because it has a different meaning depending on who wrote it. Ugly.

Note: Let me know if this is a clear way to demonstrate it.

Value 2 is much more useful than value 1, so we join Wall Street in throwing value 1 in the trash.

Results for FFO As Adjusted / Wall Street FFO (Value 2)

- Consensus FFO estimate: $2.39

- FFO Result: $2.39

- Result in line with estimate.

Results for AFFO (Value 3)

- Consensus AFFO estimate: $1.99

- Result: ARE does not report AFFO.

Early Guidance

Management held an “investor day” event previously. They previewed the 2025 guidance.

Guidance for FFO (Value 1, Useless)

- Old Guidance for 2025 FFO: $9.23 to $9.43 (midpoint $9.33)

- New Guidance for 2025 FFO: $9.23 to $9.43 (midpoint $9.33)

- Change: $0.00.

- Note: This is not particularly important. The headline metric should be FFO as Adjusted.

- Guidance for FFO and FFO and As Adjusted is currently identical.

Guidance for FFO as Adjusted (Value 2)

- Old Guidance for 2025 FFO: $9.23 to $9.43 (midpoint $9.33)

- New Guidance for 2025 FFO: $9.23 to $9.43 (midpoint $9.33)

- Change: $0.00.

- Consensus Estimate for 2025: $9.27

- Guidance is $.06 above consensus.

The Takeaway

Nothing changed. I’ll take this as a positive given the guidance being above consensus estimates.

Changing Capital Allocation

Minimal change:

Source: Alexandria Real Estate

Green boxes for things that didn’t change. Purple indicates the change. Higher expected sales of real estate.

The ATM Program and Buybacks

ARE improved value for shareholders, particularly in January.

From the release:

Nice work. They settled the rest of their forward equity sales which were previously locked in at $120.93. They used those proceeds, along with other cash, to repurchase 2 million shares at $98.16. It’s great to see ARE putting that capital to work. Selling real estate contributes to the negative pressure on real estate values, but it allows ARE to get cash for share buybacks without jacking up leverage.

Leasing Spreads

Just a quick note here. If you appreciate my research, please sign up. You'll get the rest of the article for free after signing up. You won't get spammed with advertisements. You will occasionally get a nice article, like this one, delivered to your inbox for free.