A Few Quick Notes on Inflation

The recent CPI report showed inflation a bit higher than projected.

Data is (stupidly) rounded. This rounding resulted in rounding up, rather than rounding down.

Just a suggestion, but month over month values that are typically in the 0.1 to 0.4 range shouldn’t be rounded to one decimal place.

It leads to stupid headline metrics. Neither predictions nor reported values should be rounded to one decimal place.

The market responded with higher interest rates, which pushed REIT prices lower.

Today rates are down, but the market is shifting away from risk, so most equity prices are lower.

What is Driving Inflation

Two factors:

- Delayed data on “shelter”. We’ve covered that before.

- Delayed data on car insurance. Haven’t talked about this one.

Car insurance renewals may still be high, but market rates should be rising much slower.

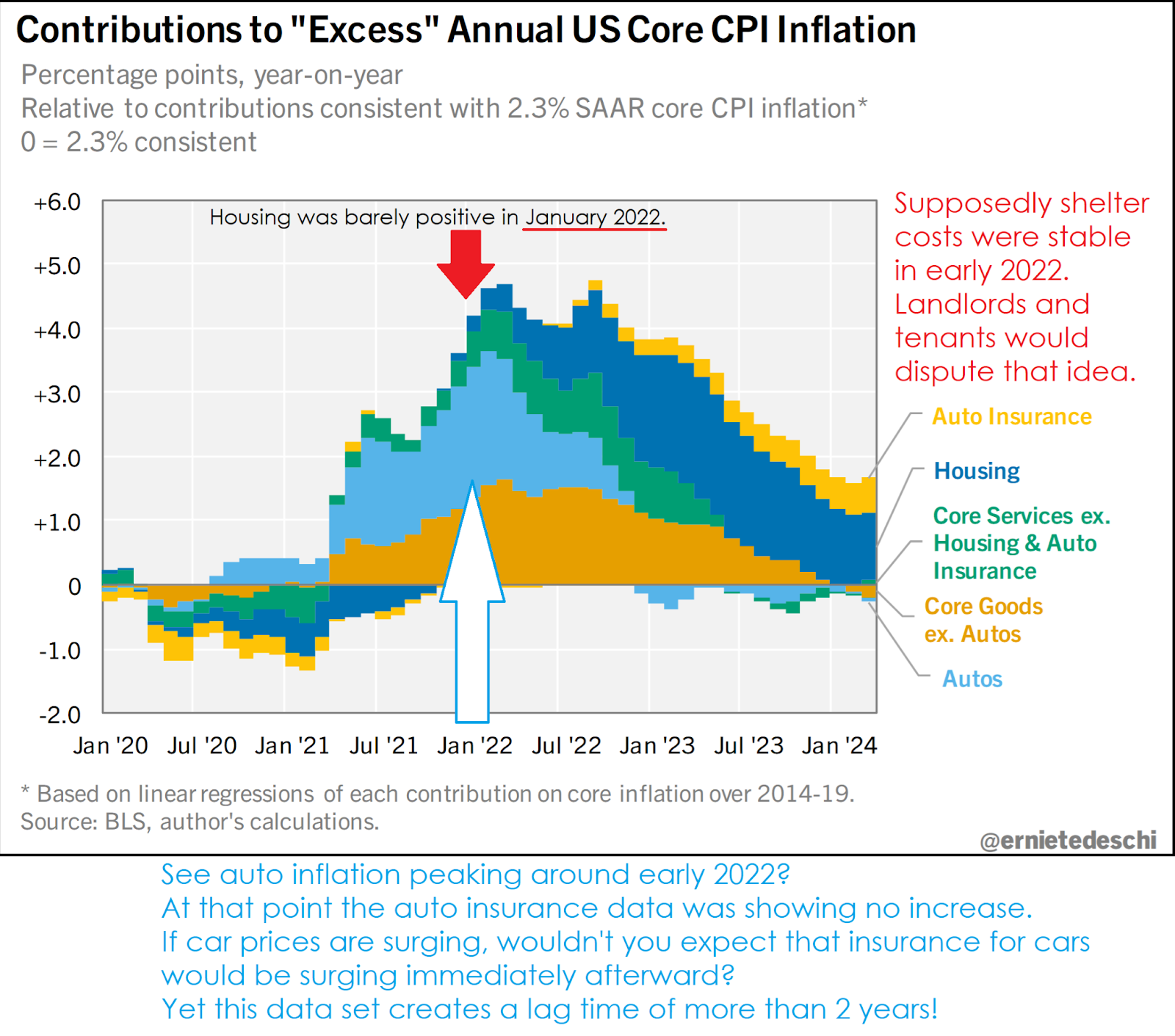

Contribution to High Inflation

I pulled this nice chart off Twitter and added some notes:

The chart compares how much each item contributed to “inflation” being above or below 2.3%.

A tall bar indicates a big contribution. A negative bar indicates it was reducing “inflation” compared to 2.3%.

Using this chart, we can see that when inflation was reaching its first year-over-year peak in January 2022:

- Shelter was contributing almost nothing.

- Auto insurance had a negative contribution.

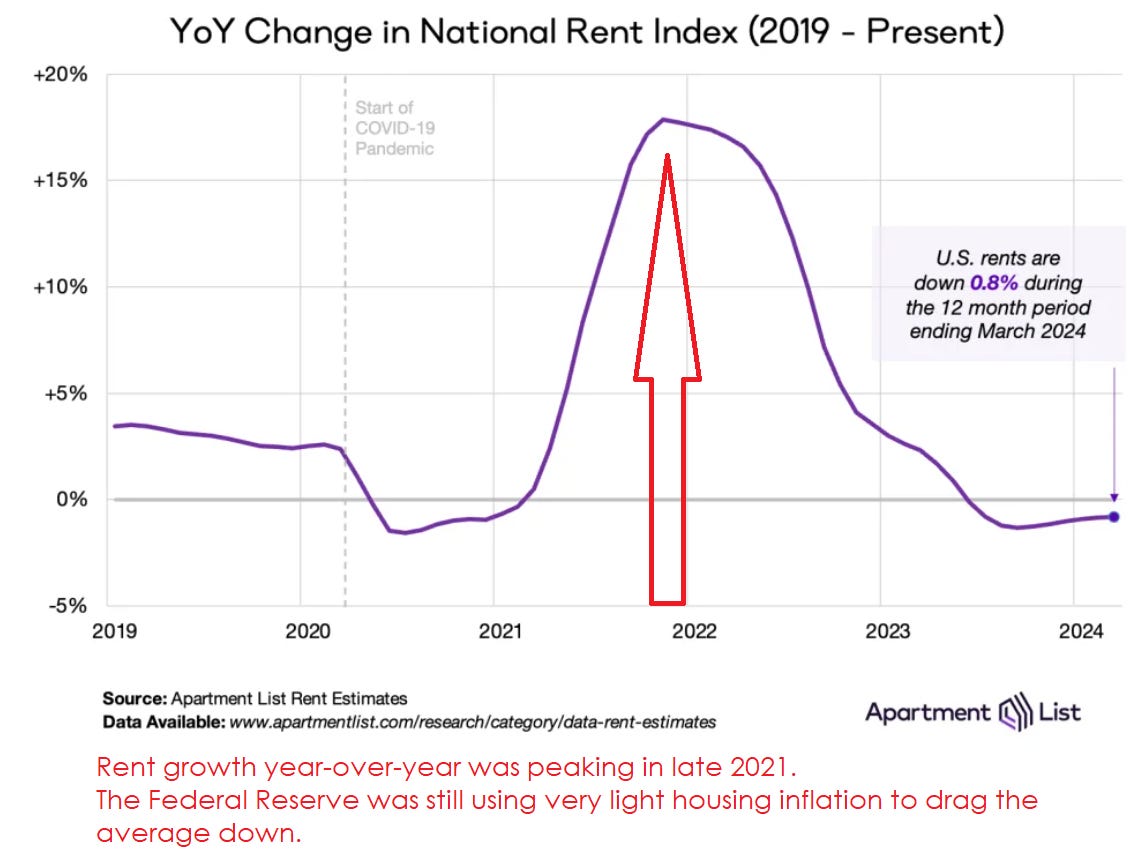

Touching on Shelter

While the official data shows very low housing inflation in January 2022, that was actually just after apartment rents peaked:

The shelter data is so lagged that it was barely increasing “inflation” in the months where it was actually the highest.

Today, the national rent index is negative and yet housing is the single largest contributor to “high inflation”.

Car Prices

We can see that car prices roughly stabilized around late 2022.

With car prices ripping higher, were insurance companies too stupid to raise insurance costs?

That seems unlikely.

However, they couldn’t raise insurance rates until policies were renewed.

Consequently, even if the price for new customers went up, many customers wouldn’t see that increase immediately.

In my opinion, the change in the market price for insurance is more important than the change in the contracted price (which lags market prices).

This data doesn’t just use the contracted price though. It lags the contracted price. Therefore, the data is “double lagged”.

Why Is Car Insurance Going Up?

I’ll give you a few reasons:

- Car prices and repairs are both more expensive (see chart above). Therefore crashes are more expensive.

- Cost of healthcare (injuries) is more expensive (common knowledge for U.S. residents). Therefore crashes are more expensive.

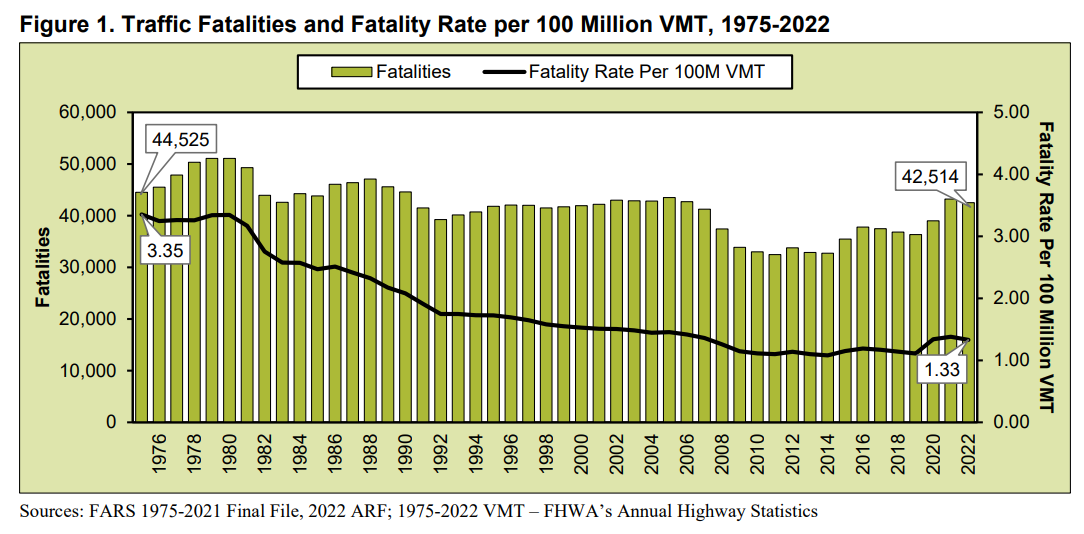

- Increase in miles driven (“back to office”) drives an increase in accidents (statistics).

Note: Data on the number of accidents is challenging to find. Most sources primarily track fatalities. - Car thefts have been rising for a few years. This is at least partially due to poor anti-theft features.

Quick Charts

Fatalities jumped higher following the pandemic:

I would prefer a chart for data on crashes, but such data is not readily available.

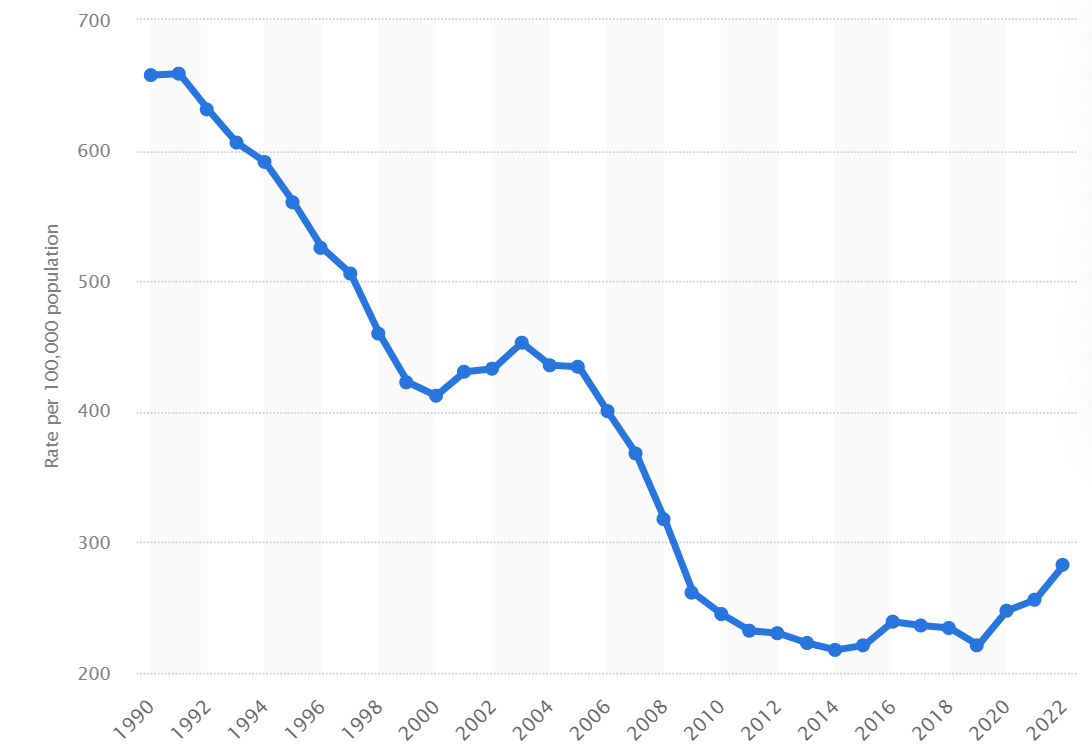

Increase in car thefts:

Car Thefts

0.25% to 0.28% of U.S. residents (depending on source) would have their car stolen each year.

It’s actually much higher in some areas.

0.79% of Colorado residents would have their car stolen.

How Can I Reduce Car Theft?

We’re skipping past ideas like “store it in the garage”.

My favorite is the modified Apple Air Tags.

A competent thief will scan the vehicle just before or after stealing it to check for air tags.

The Air Tag contains a speaker that can be used to find it.

That’s nice for finding your keys, but it also helps thieves locate the Air Tag and remove it.

There’s a simple Youtube tutorial on removing the speaker and hiding the Air Tag in the car.

That hidden Air Tag is a huge incentive for the thief to ditch the vehicle and look for an easier target.

If they ditch the vehicle, it’s easy to recover.

Inflation Expectations

Since the biggest factor boosting “inflation” is the lagged shelter data, we could see that ease over the next year.

Car insurance may continue to be a headwind.

Military conflicts tend to increase inflation. Whether those escalate or ease, it could swing inflation.

Long-term, I think we’ll see inflation pick up again.

Why? Because deficits will increase.

Which will grow faster:

- Dollars in circulation

- Production of goods and services

It’s dollars. Of course it’s dollars. Deficits are in the trillions. Most of the spending is “mandatory spending”.

Mandatory spending is another term for entitlements:

- Social Security spending goes up every year.

- Medicare spending goes up almost every year.

- Medicaid spending goes up almost every year.

Those huge expenses will be joined by another value that will be climbing rapidly:

- Interest expense.

When interest rates were near 0%:

- The debt was growing.

- The debt was barely compounding.

Now that rates are higher, there is a much larger compounding impact.

That gives us another major expense that is growing rapidly.

What Most People Still Get Wrong

Many people believed quantitative easing (buying bonds and pushing rates down) would create massive inflation.

That was standard economic theory.

It was proven dramatically wrong from 2008 to 2018.

The people who sold their Treasuries to the Federal Reserve used the cash to buy one of the following:

- Bonds.

- Stocks.

Guess which prices went up?

- Bonds.

- Stocks.

When those prices go up, it isn’t counted as “inflation”.

Quantitative easing did not cause inflation for over 10 years. It didn’t suddenly cause inflation.

You should know that intuitively.

Sadly, many people still proclaim that it was QE driving inflation today.

What Would Have Caused Inflation From 2008 to 2018?

Buying consumer goods and services.

This is pretty simple. Just look at where the demand goes.

Whatever the government is buying will go up in price.

Likewise, if the government gives people cash, whatever those people want to buy will go up in price.

When the Federal government sends out cash, it drives inflation in the price of consumer goods and services.

When the Federal Reserve buys bonds, it drives inflation in the price of bonds and stocks.

Say it with me:

- Monetary policy (buying bonds) causes inflation in financial assets (bonds and stocks).

- Fiscal policy (which is mainly deficit spending) causes inflation in consumer goods and services.

The Impact on REIT Prices

There are times when the correlation between bond prices and REIT prices is very low. There are also times when it is more significant.

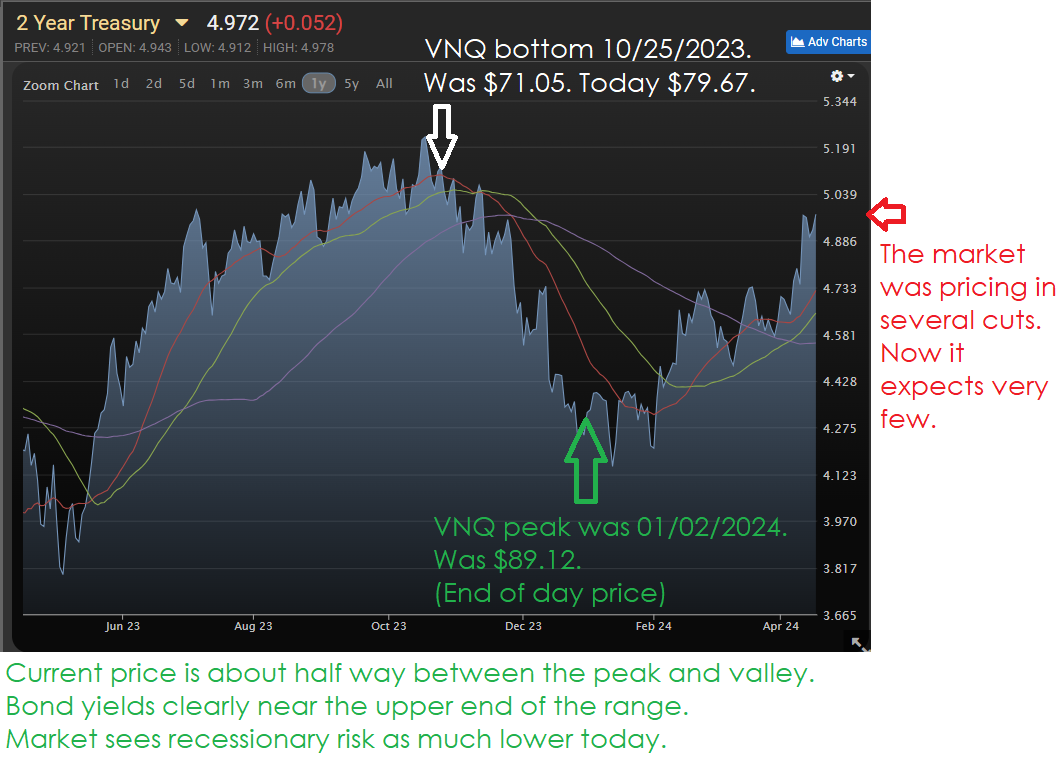

Looking at the chart for the 2-year Treasury and highlighting the tops and bottoms for the Vanguard Real Estate ETF (VNQ) $VNQ demonstrates the strong correlation here.

The good news is that rates have room to fall. However, we’re not projecting several cuts. We didn’t project them at the start of the year either (when the market did).

We’ve been consistently saying that the Federal Reserve will be slow to cut rates.

We’ve been using a mix of:

- Equity REITs with strong long-term fundamentals

- Preferred shares approaching their floating dates.

- A few trading opportunities in the mortgage REITs.

- Baby bonds to mix yield with lower risk levels.

We’re still down year-to-date (mainly due to April), but we’re beating the index ETFs for our sectors by a respectable margin. As of 4/16/2024 (middle of the day), we’re beating the average by about 2.5%.

Conclusion

Inflation was much higher than reported in 2021.

Inflation is actually lower than reported today.

In the next several years, expect inflation to rise again.

That’s because the amount of dollars in the economy increases faster than the amount of stuff available for purchase.

In the short-term, cash is a viable hedge against recessions.

In the long-term, inflation will eat away the value of cash.

Because of the value of hedging against recessions (and the current yield on cash), I still have some cash in the portfolio.

However, I’m wary of being too heavily invested in cash long term. As we spot big dips in some of the shares we want, I’ll probably put some cash to work.

Thankfully volatility can often drive some trading opportunities between preferred shares. That’s wonderful because the alpha from swapping between similar shares is some of the easiest alpha we can earn.

Member discussion