13% Dividend Yield and 12% Upside

- Despite big yields, these shares are still cheap.

- Fat dividends that grow with short-term rates are a nice hedge.

- The yields are between 9% and 9.5% today, but they are due for a big dividend increase starting in March 2024. Bigger dividends should increase valuation.

- The big risk factor would be home prices or the economy plunging. Not just a dip.

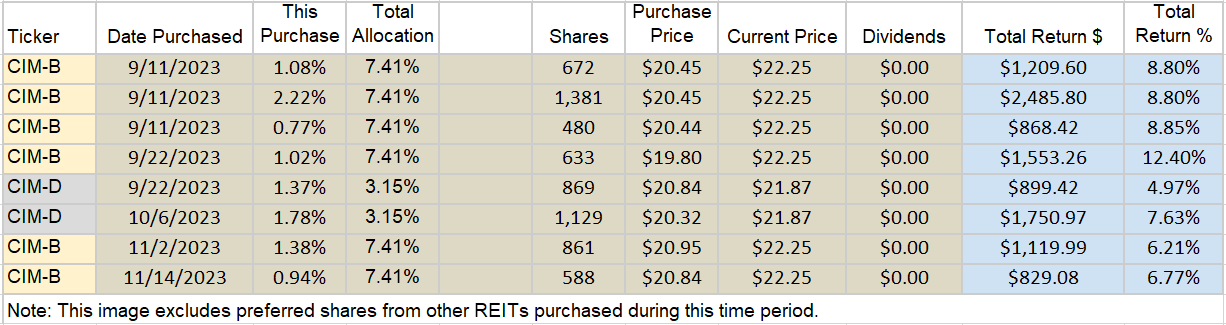

- I’ve built significant positions in these shares to take advantage of the upcoming dividend increase.

Brief Summary

The article focuses on CIM-B and CIM-D. These are two shares we’ve purchased frequently over the last 3 months.

We’re looking at the expected dividend yield when the floating rate kicks in (starts 3/30/2024) and the upside to call value. I’m not predicting a call, but I do think the dividend increase (or anticipation of it) should drive shares much closer to $25.00. There’s a pretty good chance prices are at least over $24.00 after the shares are floating, so long as we aren’t in a rough recession and short-term rates are relatively unchanged.

Link to Article

This article was posted on Seeking Alpha. However, I ensured that all our members can access it for free. No login or account required!

Here is a link to the recent article.

Thanks for reading.

PS. Most of our content will still come out through this website, including all of our paid REIT Forum articles and some exclusive free articles. To maintain a presence on Seeking Alpha, it helps to post some articles there. However, I want to ensure that my followers here are not missing out. My solution is to provide a free link for those articles.

Member discussion