10 Big REIT Bargains

There are some REITs you should be considering:

- Camden Property Trust (CPT)

- Essex Property Trust (ESS)

- Mid-America Apartment Communities (MAA)

- Sun Communities (SUI)

- American Tower (AMT)

- Crown Castle International (CCI)

- SBA Communications (SBAC)

- Terreno Realty (TRNO)

- Rexford (REXR)

- W.P. Carey (WPC)

- Alexandria (ARE)

So many REITs in one article? Better keep it fast.

Housing REITs

We've got two kinds of housing.

- Apartment REITs: CPT, ESS, and MAA

- MH Park REITs: SUI

We'll do apartment REITs first.

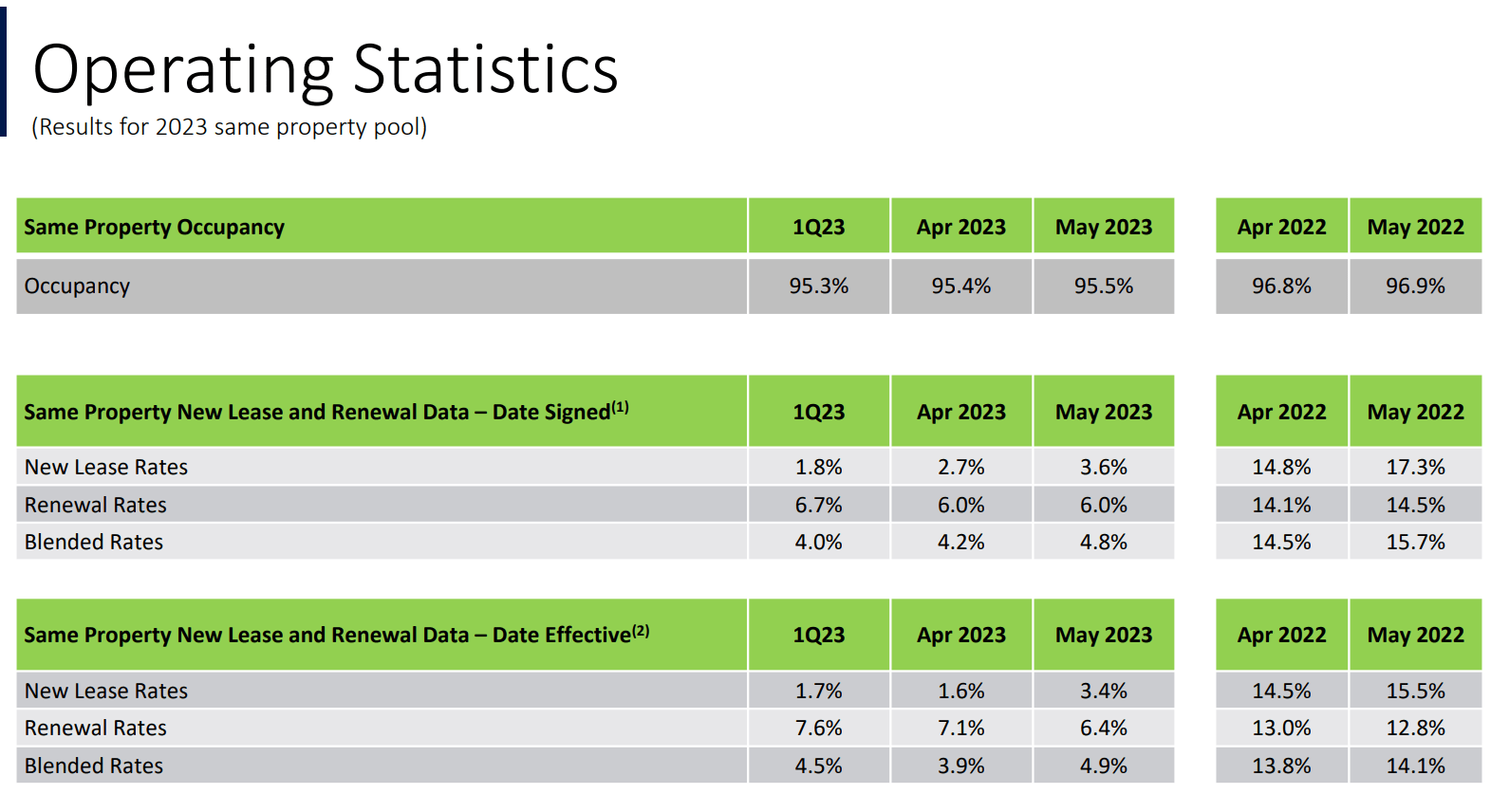

This awkwardly spaced slide (not in chronological order) shows leasing spreads are still good for CPT. They actually improved in April and May relative to Q1 2023:

Facts:

- In 2022, leasing spreads were in the mid to low teens. Official "inflation" said shelter inflation wasn't too bad.

- In 2023, leasing spreads are 4% to 5%. Official "inflation" data is propped up by using higher rates.

- The real-time data is more accurate.

- Same-property NOI guidance is 3.75% to 6.25%.

Not bad? CPT is about 7.4% off its lowest close in the last 52 weeks and the portfolio is geographically diversified.

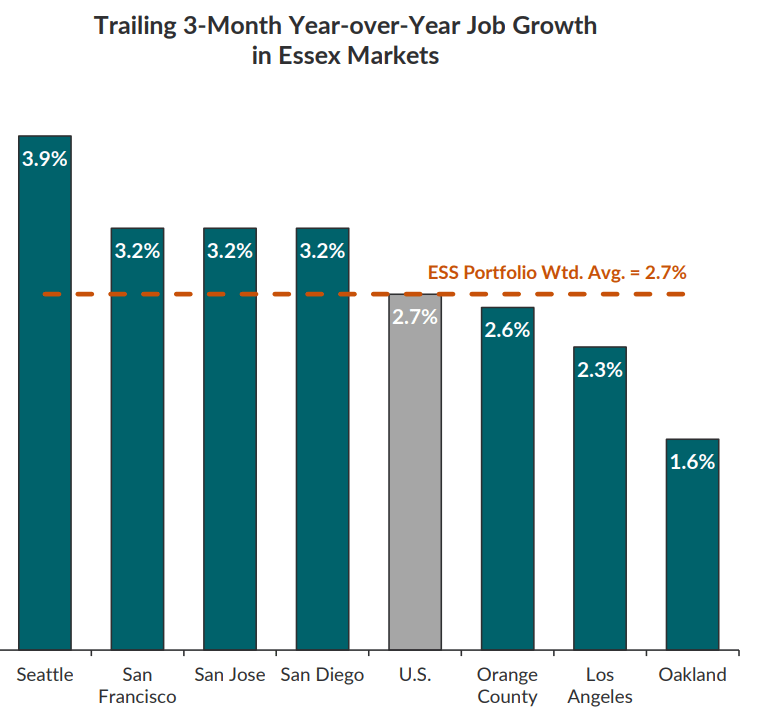

Some people don't like ESS because it's mostly in California. Despite all the doom and gloom on California, it's not a barren wasteland.

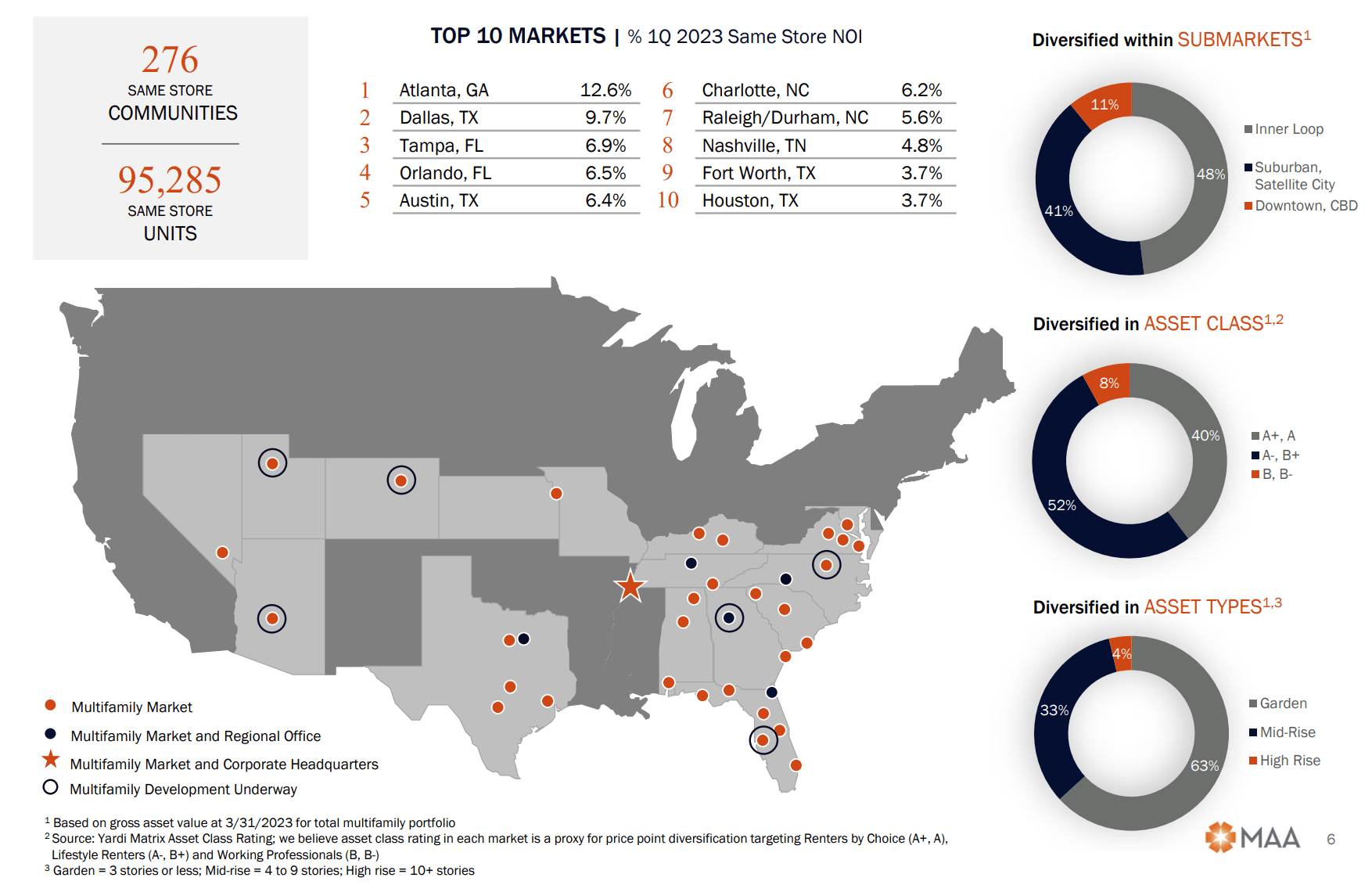

If you want more "Not California" in your profile, try MAA on for size:

MAA's valuation often pushed us away, but it's fine now. Shares are trading at much lower multiples.

How about manufactured home parks? SUI is driving strong revenue growth again:

They do that regularly. It results in strong same-property NOI (net operating income) and FFO per share growth.

SUI is one of my largest positions. I have 672 shares of SUI. At $125.83 per share (recent market price), that's $84,557.76.

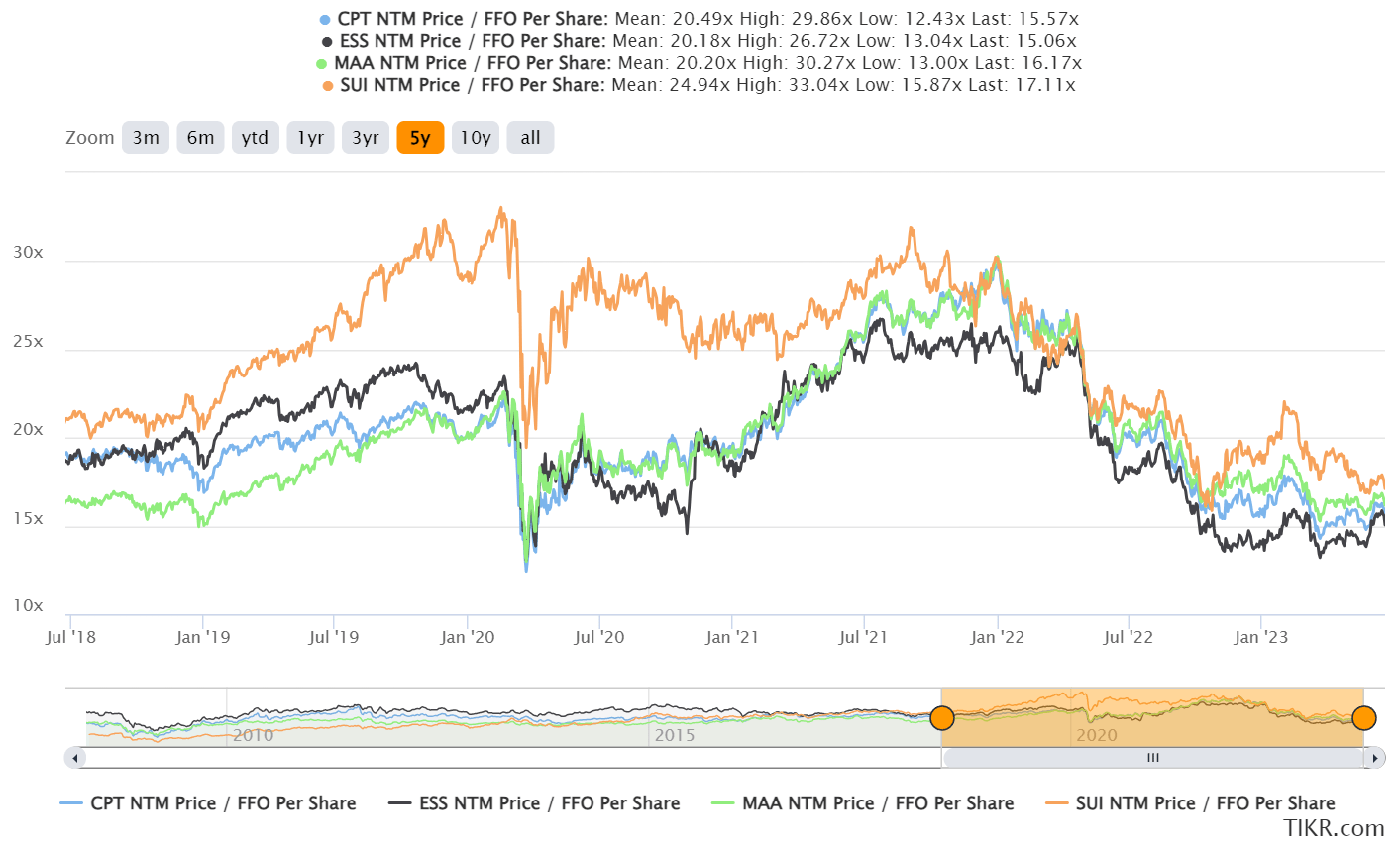

Multiples came down substantially for these REITs:

The decline in multiples was a combination of falling share prices and increasing FFO per share.

Tower REITs

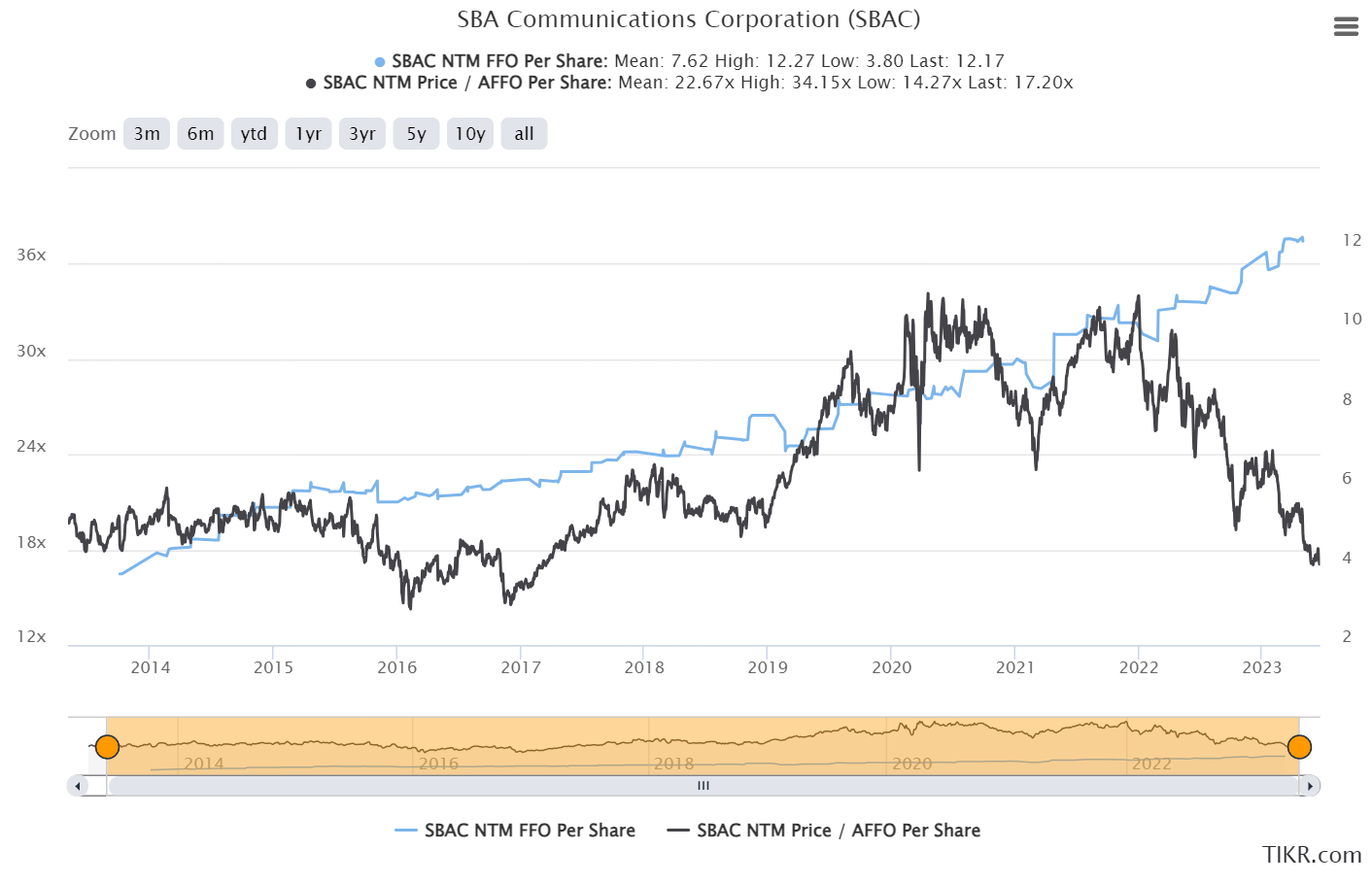

Once again:

- Massive growth in FFO and AFFO per share

- Compressed Multiple

See the chart:

I expect it to climb significantly again next year. In 2023, they aim to pay off about $1 billion in floating-rate debt. That saves them a good chunk of money on interest expenses for next year. They won't be able to repeat that trick, though. They will be around $0 of floating-rate debt at the start of 2024. At that point, I would expect them to be focusing more on doing buybacks.

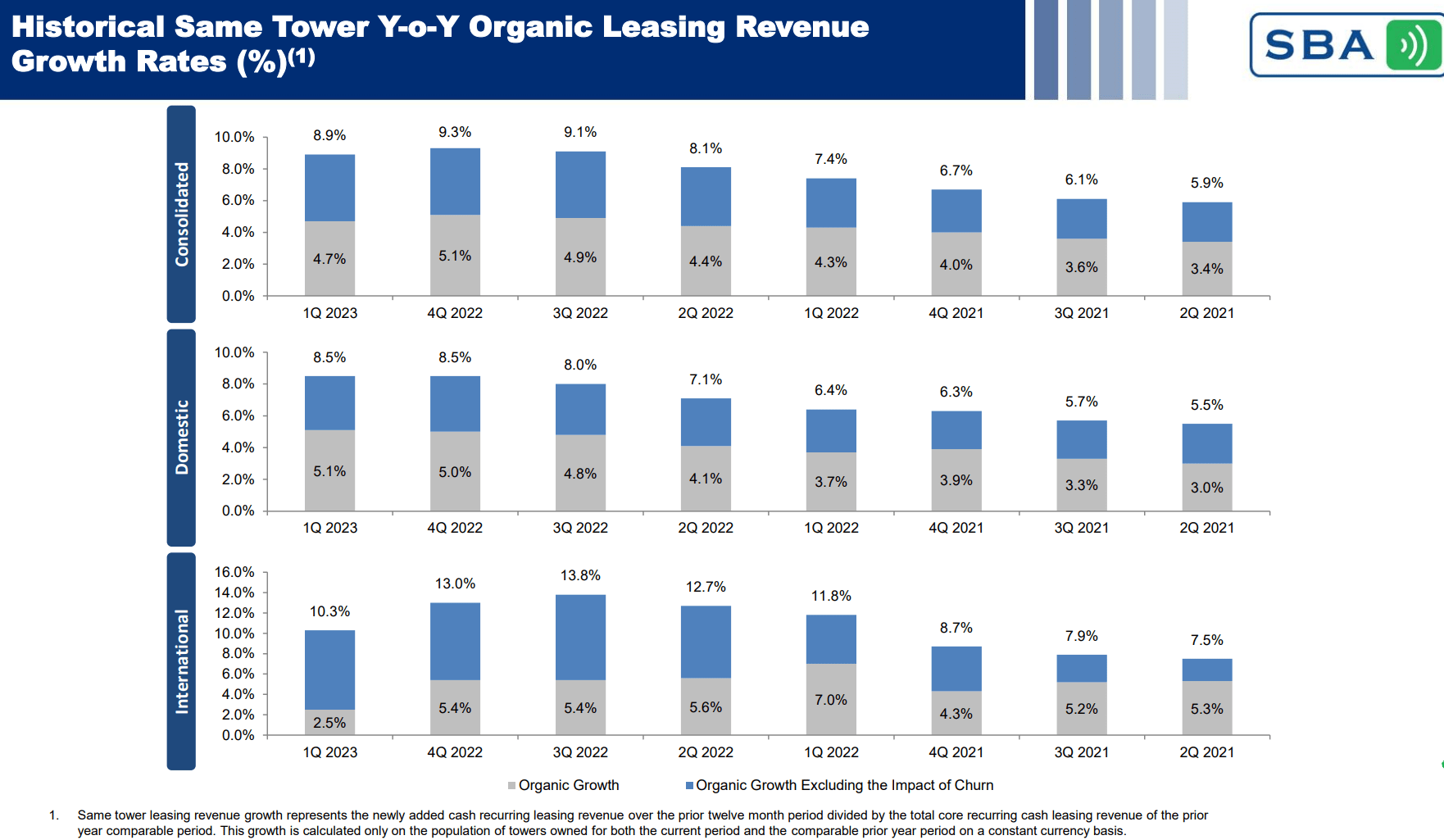

Think the big carriers are done leasing? It doesn't seem that way. In Q1 2023 they saw a dip in the organic growth on international towers, but domestic towers put up a great quarter. After adjusting for churn (the leases that expire without a replacement), they still had 5.1% growth in the domestic market:

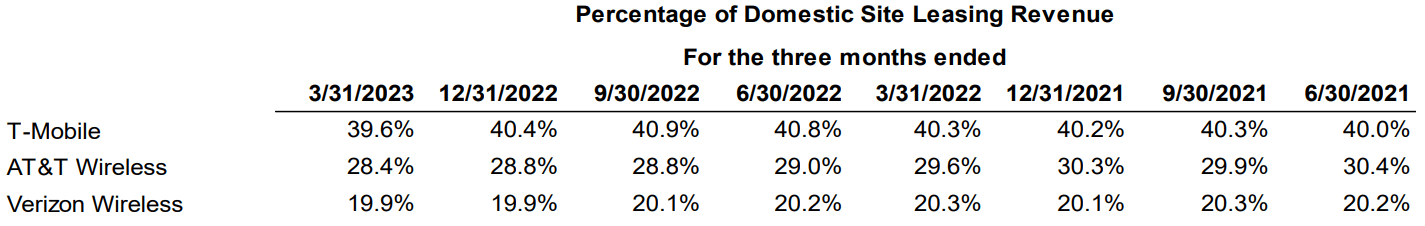

Think the big carriers are not leasing from them? Think again.

AMT and CCI look like bargains, also. CCI has more difficulty with expiring leases, but also trades at an unusually low multiple of FFO and AFFO. That creates plenty of cushion.

All 3 of these REITs saw their growth rate in FFO and AFFO per share challenged by the increase in interest rates. They didn't lock in fixed rates on enough of their debt. However, we're already through the worst of the hikes. Perhaps all, but we could still see another 1 or 2 hikes before the Federal Reserve is confident they can claim credit for slaying inflation. We shouldn't, but we certainly could.

Jerome Powell and this board of directors are great economic forecasters.

-Noone Ever

They were still signing customers and growing revenues, but interest expense was up. SBAC is the only one wiping out floating rate debt (using the cash they retained from paying a tiny dividend). However, the next year-over-year comparison for AMT and CCI will already include 2023's interest rates. Therefore, the headwind to growth rates should be much lower.

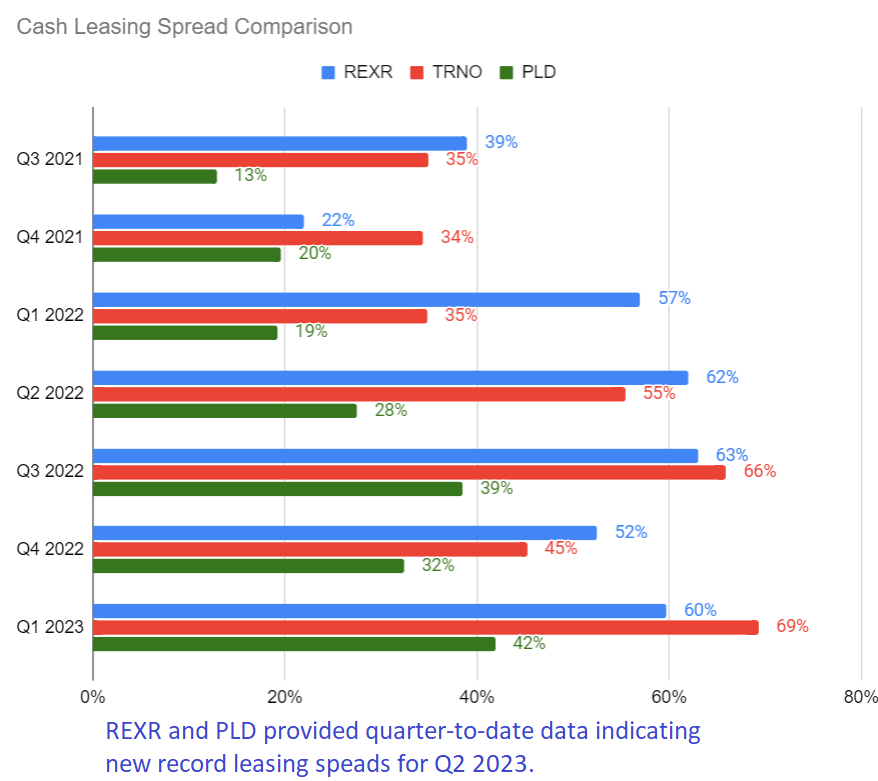

Industrial REITs

Industrial REIT leasing spreads were great for the last several quarters. REXR and PLD already indicated they are on pace for new records. REXR is near their 52-week low.

I think TRNO and REXR have been beaten down far too much.

Net Lease

I'm adding W.P. Carey (WPC) to the list. They've underperformed the other net lease REITs over the last 4 to 5 months. I think that the disparity in recent performance makes them more attractive.

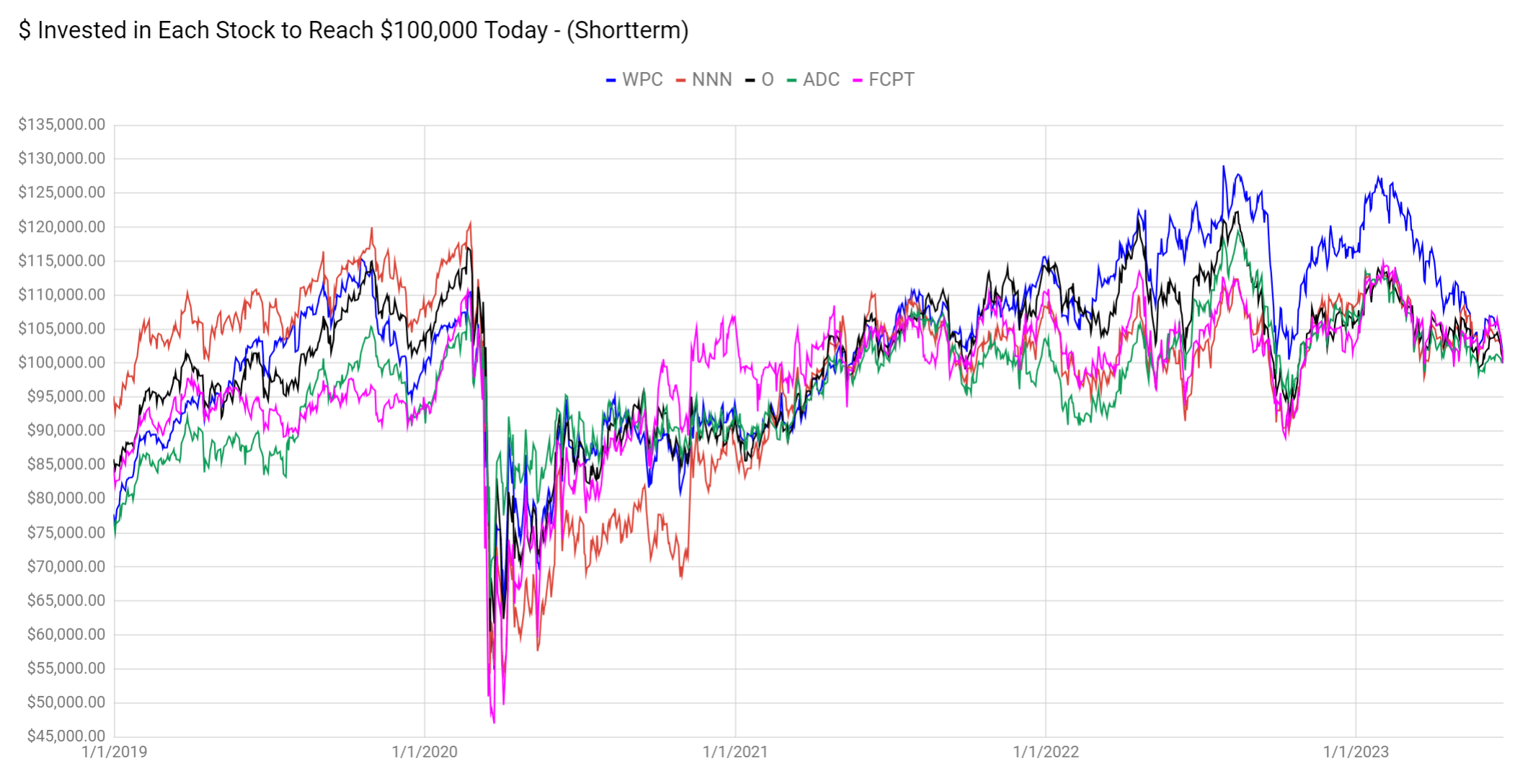

The following chart shows how much needed to be invested on any day to reach $100k today with dividends reinvested:

You'll notice WPC was one of the best-performing net lease REITs if you start back in early 2019. However, they took a significant hit recently. That gap makes them look better. They underperformed Realty Income (O), National Retail Properties (NNN), Agree Realty (ADC), and Four Corners Property Trust (FCPT) by a material margin.

- Old triple net lease REITs correlation: Rates up, REITs down

- Today's correlation: Don't care about rates.

Much of a triple net lease REITs future cash flow is already locked in, so it would make sense for interest rates to impact them more than most other REITs.

Regardless, they outperformed other types of REITs. The big culprit may be dividend yields. In general, equity REITs that deal in properties with lower cap rates (and thus have lower dividend yields) saw larger declines in share prices. Net lease properties generally have medium-high cap rates.

Biotech Lab

Alexandria (ARE) is a biotech lab REIT. They get labeled as office because there are not enough biotech lab REITs to create a sector. The "office" tag can impact share prices as we occasionally see the correlation with office REITs surge. Long-term, the performances are dramatically different.

ARE does at least 3 things well:

- Raises dividends

- Grows AFFO per share

- Generates wealth for shareholders

I recently prepared a subscriber article rejecting the office REIT comparison. It eviscerates the short argument.

Note: I’ll publish that article here for you in the next few days.

Simply put, lab space includes some attached offices. Customers use the space together. While demand for "office" is down, ARE posted new record leasing spreads. It wasn't a one-time thing. While Q2 2023 leasing spreads should be down from the records in Q1, they shouldn't be bad.

ARE's fundamentals and stock price have clearly diverged. Recent property sales provide further evidence that the market still values lab space.

More Charts

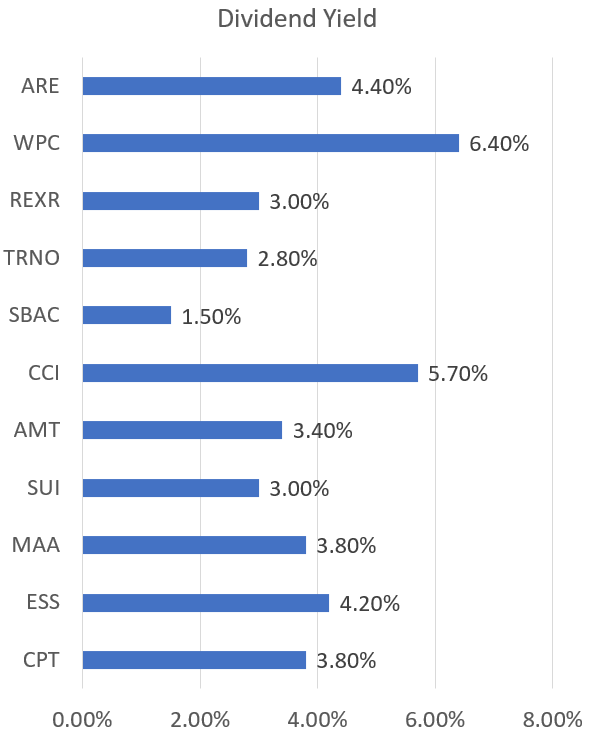

Last time I prepared a list, someone said I should've included more charts. Specifically, they wanted dividend yields:

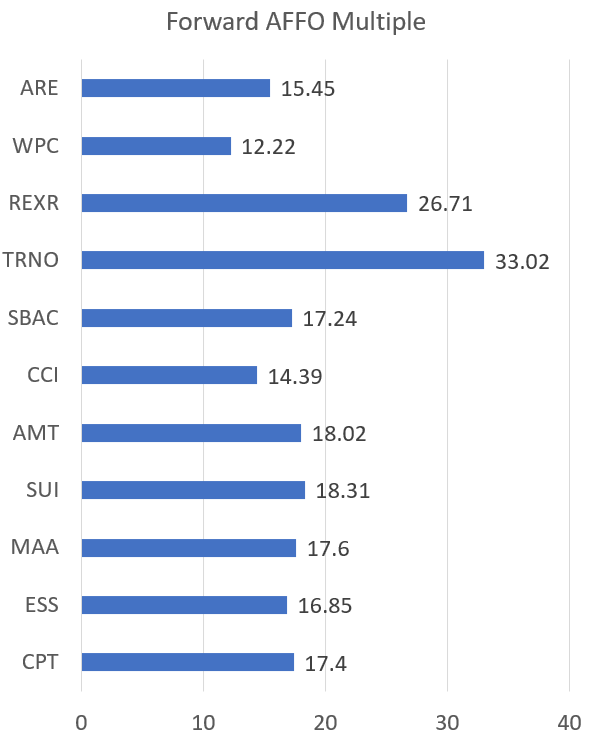

Since I don't think that's a great way to pick your investments, I also included AFFO multiples:

AFFO multiples can be important. But they should be used with an eye on future growth rates. REXR and TRNO have the highest multiples, but most of their portfolios are leased far below current market rents. As those leases are replaced by new leases, they have an enormous amount of embedded growth. If the leases were all reset to current market rent overnight (which cannot be legally done), the multiples would be far lower.

Conclusion

Ten great REIT choices. There are actually eleven, but who clicks on eleven?

Member discussion